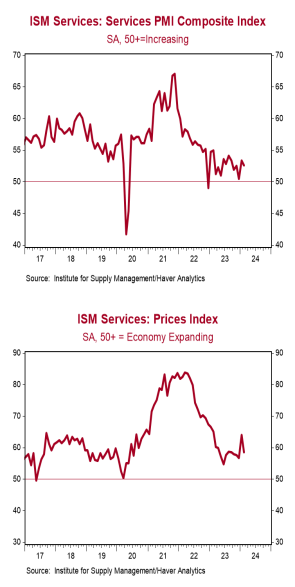

- The ISM Non-Manufacturing index declined to 52.6 in February, lagging the consensus expected 53.0 (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in February. The business activity index rose to 57.2 from 55.8, while the new orders index increased to 56.1 from 55.0. The employment index declined to 48.0 from 50.5, while the supplier deliveries index dropped to 48.9 from 52.4.

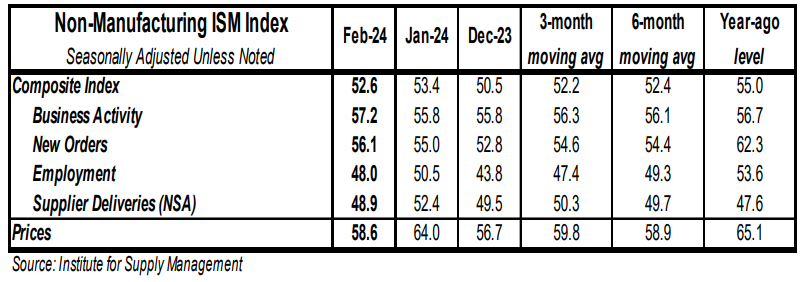

- The prices paid index declined to 58.6 in February from 64.0 in January.

Implications: Despite weakening economic data elsewhere, the US services sector remains resilient, for now. Services activity continued expanding in February, with fourteen out of eighteen major industries reporting growth, although not as fast as in January. Looking at the details, the indexes for business activity and new orders – the two forward-looking pieces of the report – both rose in February, and sit at five- and six-month highs, respectively. The pullback in the headline index was due to faster deliveries in February (signaled by a sub-50 reading in the supplier deliveries index), as well as the employment index falling back into contraction territory. Hiring activity in the services sector looks to be cooling in recent months, as the index sits in contraction territory for the second time in three months, while more industries reported a decline in employment in February versus an increase. On the inflation front, prices continued to rise in the services sector, now for the 81st month in a row. Although the index is well below the back-breaking pace from 2021-22, make no mistake, inflation remains a problem in the services sector; thirteen industries reporting paying higher prices during the month of February. When you contrast the details of today’s report with the February ISM report on the manufacturing sector – where activity has contracted sixteen consecutive months and the majority of industries reported contraction or no growth – there has clearly been a divergence in activity. The services sector was a lifeline for the US economy in 2023. What do we expect this year? An eventual weakening as the economic morphine from COVID wears off and the impact of the recent reductions in the M2 measure of the money supply make their way through the economy. We continue to believe a recession is on the way and think investors should stay cautious as we move through these unprecedented times. In other recent news, Americans bought cars and light trucks at a 15.8 million annual rate in February, up 6.0% from January and 6.3% higher than a year ago.