View from the Observation Deck

We update this post on small-capitalization (cap) stocks every now and then so that investors can see which of the two styles (growth or value) are delivering the better results. Click Here to view our last post on this topic.

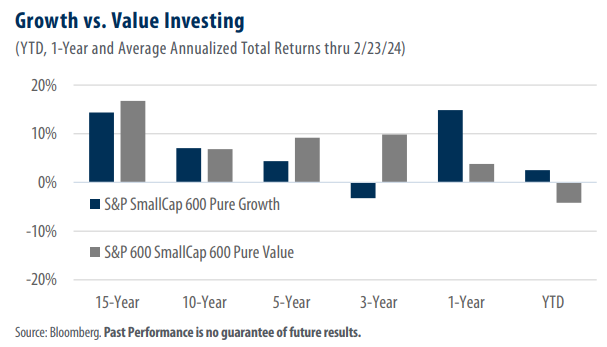

• As today’s chart reveals, the S&P SmallCap 600 Pure Growth Index (Pure Growth Index) outperformed the S&P SmallCap 600 Pure Value Index (Pure Value Index) by a significant margin over both the 1-Year and year-to-date (YTD) time frames.

• In our last post on this topic, we noted that the Information Technology Sector comprised 19.8% and 6.4% of the Pure Growth and Pure Value Indices, respectively.

On a trailing 12-month basis thru February 23, 2024, the S&P SmallCap 600 Information Technology Index posted a total return of 5.94%. For comparative purposes, the S&P SmallCap 600 Index was up 4.94% on a total return basis over the same period.

The total returns in today’s chart, thru February 23, 2024, were as follows (Pure Growth vs. Pure Value):

• 15-year average annualized (14.37% vs. 16.73%)

• 10-year average annualized (7.04% vs. 6.82%)

• 5-year average annualized (4.38% vs. 9.16%)

• 3-year average annualized (-3.23 % vs. 9.83%)

• 1-year (14.86% vs. 3.80%)

• YTD (2.51% vs. -4.19%)

Takeaway

As today’s chart illustrates, the Pure Growth Index has enjoyed substantially higher total returns than the Pure Value Index over the trailing 12-month and YTD time frames (thru 2/23/24). The last time we posted about this topic, we presented the idea that sector allocations could offer insight into the divergent performance between these two benchmarks. From our perspective, that estimation still holds. While sector weightings can change, they may provide unique insight into recent performance trends, in our view.