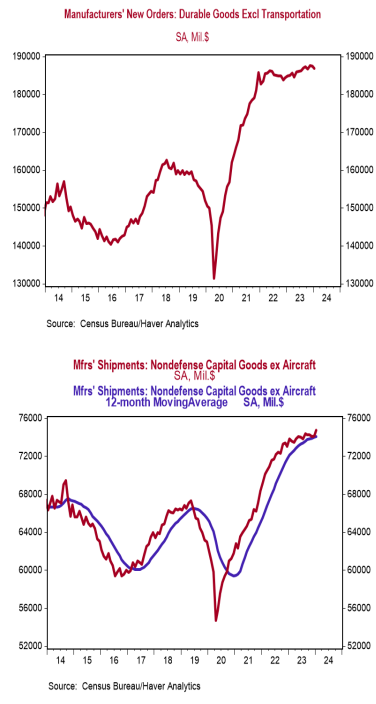

- New orders for durable goods declined 6.1% in January (-6.3% including revisions to prior months), lagging the consensus expected -5.0%. Orders excluding transportation declined 0.3% (-0.9% including revisions), versus a consensus expected +0.2%. Orders are down 0.6% from a year ago, while orders excluding transportation have risen 1.1%.

- A drop in orders for commercial aircraft led declines across most major categories in January.

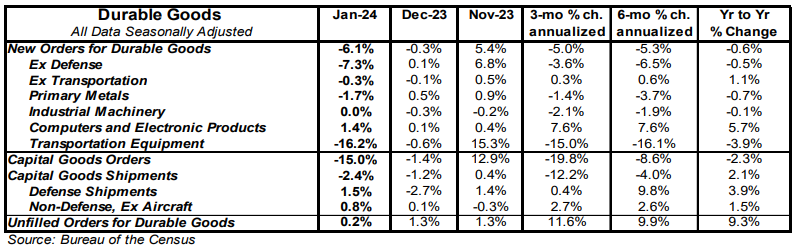

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure rose 0.8% in January. If unchanged in February and March, these orders would be up at a 3.3% annualized rate in Q1 versus the Q4 average.

- Unfilled orders rose 0.2% in January and are up 9.3% in the past year.

Implications: A major miss to the downside from durable goods orders to start 2024, as orders both including and excluding the volatile transportation category fell in January and were revised downward for prior months. The largest decline came for orders of commercial aircraft, down 58.9% in January, while motor vehicles and parts fell a more modest 0.4%. Strip out the typically volatile transportation sector and orders declined 0.3% in January while consensus expectations were looking for a 0.2% increase. To add insult to injury, December orders ex-transportation was revised down from a 0.5% rise to a 0.1% decline. Looking at the details of the report shows declining orders across most major non-transportation categories – led by primary metals (-1.7%) and fabricated metal products (-0.9%) – which were partially offset by a 1.4% increase in computers and electronic products. The ray of good hope in today’s report came from what is arguably the most important number in the release, core shipments – a key input for business investment in the calculation of GDP – which rose 0.8% in January. If unchanged in February and March, these shipments would be up at a 3.3% annualized rate in Q1 versus the Q4 average. However, shipments have been trending lower since the start of 2022, and we expect this trend will continue as the economy feels the lagged effects of the Federal Reserve’s actions to tighten monetary policy. Retail sales have declined in three of the past four months, manufacturing production excluding the auto sector has declined in each of the last four months, and durable goods are following suit, also down in three of the last four months. A number of factors are likely to keep the path forward rocky as we move through 2024: restrictive monetary policy from the Federal Reserve, the tightening of lending standards following stress in the banking sector, and withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending. In addition, the return toward services likely means goods-related activity will continue to soften in the year ahead, even as some durables that facilitate services remain healthy. In manufacturing news this morning, the Richmond Fed index, a measure of mid-Atlantic factory activity, rose to -5.0 in February from -15.0 in January. Meanwhile, on the housing front, home prices eked out small gain, with the national Case-Shiller index up 0.2% in December while the FHFA index ticked up 0.1%.