View from the Observation Deck

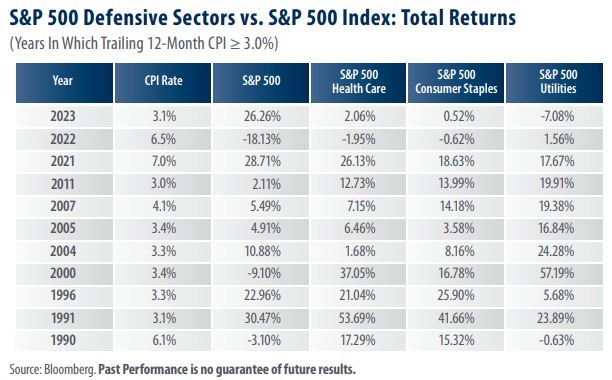

For today’s post, we looked back to 1990 and selected calendar years where inflation, as measured by the Consumer Price Index (CPI), rose by 3.0% or more on a trailing 12-month basis. We chose 3.0% as our baseline because the rate of change in the CPI averaged 3.0% from 1926-2023, according to data from the Bureau of Labor Statistics. We then selected three defensive sectors (Health Care, Consumer Staples, and Utilities) and compared their total returns to those of the S&P 500 Index over those periods.

• Of the eleven years in today’s table, there were only two (2021 and 2023) where the S&P 500 Index outperformed each of the Health Care, Consumer Staples, and Utilities sectors.

• From 12/29/89 – 12/29/23 (period captured in the table above), the average annualized total returns posted by the four equity indices presented were as follows (best to worst): 11.54% (S&P 500 Health Care); 10.35% (S&P 500 Consumer Staples); 10.19% (S&P 500); and 7.88% (S&P 500 Utilities); according to data from Bloomberg.

As many investors likely know, because defensive sectors tend to be less cyclical, they may offer better performance than their counterparts during periods of heightened volatility. Today’s table reveals that defensive sectors generally offer better performance relative to their peers during periods of higher inflation as well. That said, despite elevated inflation, the S&P 500 Index surged by 26.26% in 2023, outperforming the Health Care Index by 24.2 percentage points. In our view, several factors contributed to the S&P 500 Index’s relative outperformance during the year. First, developments in AI led to decidedly narrow participation in the equity markets. In 2023, the S&P 500 Technology, Communication Services, and Consumer Discretionary Indices accounted for nearly 87% of the total return of the broader S&P 500 Index. Second, expectations that the Federal Reserve could cut interest rates in 2024 led to higher equity valuations, particularly among those companies that may see significant benefits from AI.

Takeaway

The S&P 500 Index outperformed each of the Health Care, Consumer Staples, and Utilities sectors in just two of the eleven time frames presented in today’s table (2021 and 2023). Given these results, the obvious question is this: why did defensive stocks underperform in 2023? As we see it, investors’ risk appetite may offer one explanation. The American Association of Individual Investors reported that just 19.3% of respondents to its Investor Sentiment survey were bearish as of 12/14/23, a nearly six year low for the metric. Additionally, developments in AI led to narrow sector participation in 2023, with just three sectors accounting for nearly 87% of the S&P 500’s total return. That said, investors will often use defensive sectors as a safe haven during times of increased volatility, as well as during periods of heightened inflation. We would expect to see more interest in defensive sectors should volatility rise or the U.S. economic outlook sour in the coming months.