View from the Observation Deck

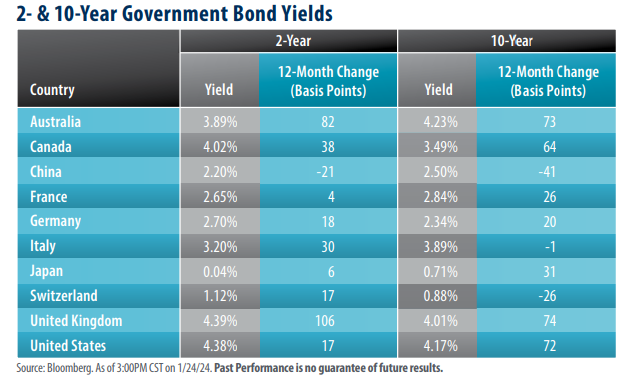

We update today’s table on a regular basis to show the impact monetary policy could be having on government bond yields. As many investors are likely aware, after more than a year of increasingly tighter monetary policy, numerous global central banks have held off on raising policy rates further, effectively “pausing” to allow the impact of previous rate hikes to take full effect. In the U.S., for example, the Federal Reserve (“Fed”) increased the federal funds target rate (upper bound) eleven times, from 0.25%, where it stood on 3/15/22, to 5.50% on 7/26/23. The Fed has met three additional times since July, voting to leave their policy rate unchanged in each of those meetings.

Despite tighter monetary policy, headline inflation rates are still above target levels in seven of the ten countries listed in today’s table (China, Italy, and Switzerland being the only exceptions), but have come down dramatically.

While it is not presented in today’s table, the pace of inflation, which was the impetus for elevated policy rates, remains stubbornly high across the globe. The resilience of rising prices sits at the forefront of the continued debate regarding the Fed’s path moving forward. While the Fed did announce that it was likely to cut the U.S. policy rate in 2024, the timing and depth of those cuts remains unknown, and could depend largely on near-term economic data. That said, U.S. inflation, as measured by the trailing 12-month change in the consumer price index, stood at 3.4% on 12/29/23, representing a decline of 5.7 percentage points from when it stood at 9.1% on 6/30/22.

The yield curve between the U.S. 10-Year Treasury Note (T-note) and the 2-Year T-note remains inverted.

Historically, an inverted yield curve has been a fairly accurate indicator of an impending economic recession. Data from the Federal Reserve Bank of San Francisco shows that an inverted yield curve has been a precursor to each of the last 10 economic recessions in the U.S. since 1955. As of 1/24/24, the yield curve between the 2-Year and 10-Year T-notes has been inverted for nearly 19 consecutive months.

Real yields (yield minus inflation) offered by government bonds have become increasingly attractive.

As shown in the columns marked “12-Month Change (Basis Points)”, the yields on most of the government bonds in today’s table rose over the past 12-months, providing ballast to real yields. In addition, many major economies are seeing price increases slowly come down. As of 1/24/24, five of the ten countries represented in today’s table have a positive real yield on their 10-year note (up from three the last time we posted on this topic). The five countries and their respective real yields are as follows: Italy (3.29%); China (2.80%); the U.S. (0.77%); Canada (0.09%); and the U.K. (0.01%). Click here to view our post from 8/22/23, where we wrote about the real yield on the 10-year T-note in more detail.

Takeaway

Despite the tighter monetary policies enacted by central banks around the world, inflation remains stubbornly high. Just

three of the countries in today’s table boast headline inflation readings that are below their stated target rate (China, Italy,

and Switzerland). The impact of higher interest rates on bond yields has been notable, with most of the countries in today’s

table experiencing higher yields on a year-over-year basis. That said, global inflation is growing at a slower pace, leading

some central banks to pause further rate hikes, and others to cut their policy rate. The global fixed income markets surged

in November and December of 2023, driven by the expectation of further cuts in the first half of 2024. The total return for

the Bloomberg Global Aggregate Bond and Bloomberg U.S. Aggregate Bond Indices stood at 9.41% and 8.53%, respectively,

over the two-month period. In December, the U.S. Federal Reserve gave credence to these projections, announcing that the

federal funds target rate could be reduced by as much as 75 bps over three meetings in 2024. The timing and depth of these

cuts remains unknown and could be largely data dependent. We will continue to monitor the situation and report back as new

developments occur.