View from the Observation Deck

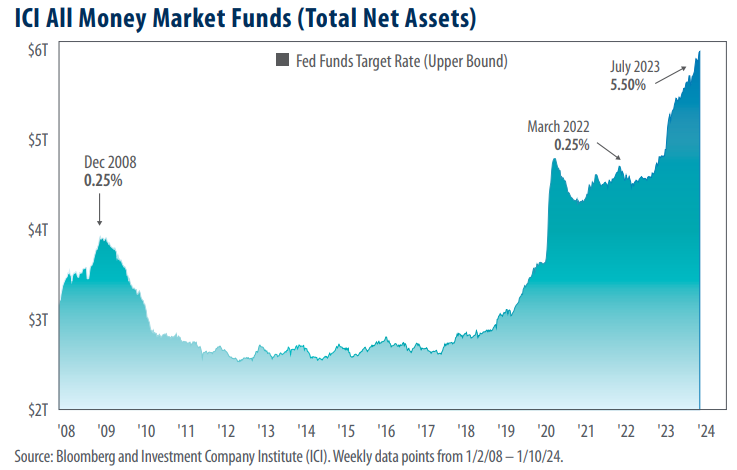

Investors tend to utilize money market funds during times of uncertainty such as the financial crisis in 2008 – 2009, the COVID-19 pandemic of 2020, and the banking crisis in March 2023. Notably, even though the S&P 500 Index moved back into bull market territory in June and closed 2023 with a gain of 26.26%, investors continued to pile cash into money market accounts (see chart). A note about the chart: we use the federal funds target rate (upper bound) as a proxy for short-term interest rates, such as those offered by taxable money market funds and other savings vehicles. In our opinion, this proxy may offer insight into the potential effect of short-term rates on investor behavior.

• After growing to an all-time high of $5.71 trillion in October 2023 (the last time we posted on this

topic), total net assets in U.S. money market accounts surged to a record $5.98 trillion in January 2024.

As of 1/10/24, total net money market fund assets stood at $5.98 trillion, approximately $2.05 trillion, and $1.19

trillion higher than their levels on 1/14/09 (peak during financial crisis) and 5/20/20 (peak during COVID-19 pandemic),

respectively.

• From March 2020 to March 2022, the Federal Reserve (“Fed”) kept the federal funds target rate (upper

bound) at 0.25%. Since then, the Fed initiated eleven increases to their target rate, raising it from

0.25% to 5.50% where it stands today.

• Inflation, as measured by the 12-month change in the consumer price index (CPI), stood at 3.4% on

12/31/23, down substantially from its high of 9.1% on June 30, 2022, but up from 3.1% on 11/30/23.

We think that these two factors, combined with the threat of an economic recession in the U.S., may partially explain why total net assets in U.S. money market accounts continue to rise. Stubbornly high inflation was a headwind to real yields (yield minus inflation) for much of 2022 and 2023. We wrote on this topic in August (click here to read “Finally, a Real Yield”), but suffice it to say that money market accounts and other fixed income instruments may become increasingly attractive alternatives to equity investments as their real yields rise.

Takeaway

Total net U.S. money market fund assets stood at a record $5.98 trillion on 1/10/24, representing an increase of $1.19 trillion since their peak during the COVID-19 pandemic. In our view, positive real yields brought on by higher interest rates and easing inflation, combined with concerns of a U.S. economic recession, may be driving money market assets higher. We think it is healthy to see yields trending upward, but investors should be aware that allocations to less-risky assets may come at a cost to positive returns. While money market funds may offer principal stability and a yield, their total return has lagged the S&P 500 Index, which surged by 26.26% on a total return basis in 2023. Even accounting for the near-term risk of a recession, we believe that an allocation to equities will continue to generate a higher return on capital than cash over time.