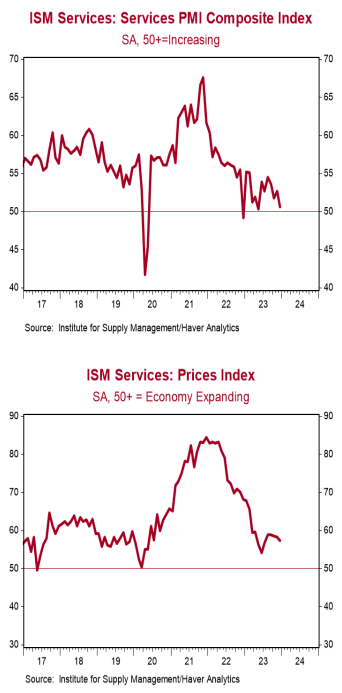

- The ISM Non-Manufacturing index declined to 50.6 in December, lagging the consensus expected 52.5 (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mostly lower in December. The business activity index increased to 56.6 from 55.1, while the new orders index declined to 52.8 from 55.5. The employment index dropped to 43.3 from 50.7, while the supplier deliveries index ticked down to 49.5 from 49.6.

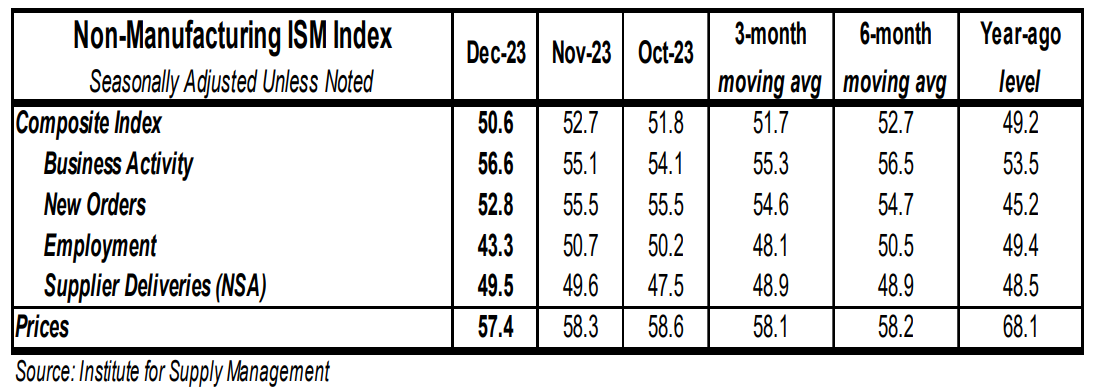

- The prices paid index declined to 57.4 in December from 58.3 in November.

Implications: Activity in the service sector expanded in December, but the pace is markedly slower. The headline index declined to 50.6 in December, missing the consensus expected 52.5, with just half of the eighteen major industries reporting growth. Part of the drop is attributed to a pullback in the new orders index, which fell to 52.8 after remaining unchanged at 55.5 the two months prior. However, business activity – the other forward-looking piece of the report – increased to a healthy 56.6. The most concerning piece of the report came from movement in the employment index, where activity contracted sharply in December. The December 43.3 reading for the employment index is the lowest since the depths of the COVID pandemic back in 2020. Notable employment comments from survey respondents cited difficulty hiring and retaining skilled workers due to their preference for remote work. Other companies are increasing layoffs in an effort to do more with less, given economic uncertainty and declining customer demand. The highest reading out of any of the categories continues to come from the prices index, which declined to a still elevated 57.4 in December. Although this is well below the back-breaking pace from 2021-22 – make no mistake – prices are still rising, and inflation remains a problem in the service sector. When you contrast the details of today’s report with the December ISM report on the manufacturing sector – where activity has contracted fourteen consecutive months and just one industry reported growth in December – there has clearly been a divergence in activity, where output has been shifting back toward services following the COVID-era when goods-related activity was artificially boosted. The service sector was a lifeline for the US economy in 2023. What do we expect in the year ahead? More weakening in the service sector, as the impact of the recent reductions in the M2 measure of the money supply make their way through the economy. We continue to believe a recession is on the way. Investors should remain vigilant as we navigate these unprecedented times.