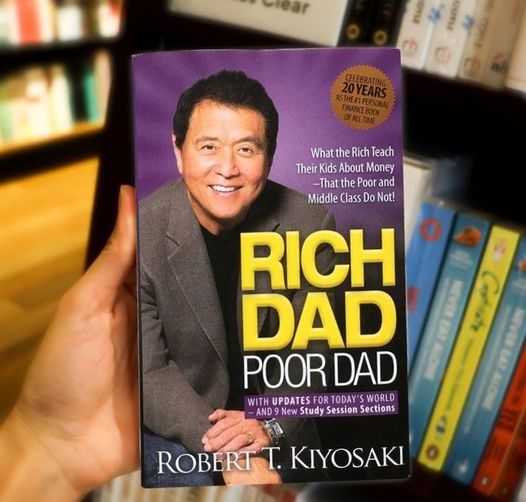

Here are 7 lessons on Rich Dad Poor Dad:

Lesson 1: The Rich Don't Work for Money; Money Works for Them

The rich have a different relationship with money than most people. They don't work for money; they make money work for them. This means that they have found ways to make their money generate income, such as through investments, businesses, or rental properties. As a result, the rich are able to earn money even when they are not actively working.

Lesson 2: It's Not How Much Money You Make, It's How Much You Keep

Many people focus on how much money they can make, but the rich focus on how much money they can keep. They are mindful of their spending and make wise financial decisions to ensure that they are able to save and invest a significant portion of their income. By keeping more of their money, the rich are able to accumulate wealth over time.

Lesson 3: The Rich Teach Their Children Financial Literacy

The rich understand that financial education is essential for success. They make sure that their children learn about money management, investing, and wealth creation from a young age. By teaching their children about money, the rich help them to develop the skills and knowledge they need to achieve financial independence.

Lesson 4: The Rich Don't Fear Failure

The rich are not afraid to take risks and fail. They understand that failure is a part of the learning process and that it can lead to success in the long run. In fact, many of the world's most successful entrepreneurs and investors have experienced significant setbacks in their careers. However, they have learned from their mistakes and used them to their advantage.

Lesson 5: The Rich Focus on the Asset Column, Not the Income Statement

The rich focus on acquiring assets that generate income and appreciating in value. They understand that assets are the key to building wealth, while liabilities, such as debt or high-maintenance luxuries, are a drain on wealth. By focusing on the asset column, the rich are able to build a solid financial foundation for themselves and their families.

Lesson 6: The Rich Work to Learn, Not for Money

The rich are always learning and expanding their knowledge. They view their work as an opportunity to grow and develop their skills, not just as a means to earn a paycheck. This focus on continuous learning helps the rich to make informed financial decisions and identify new opportunities to create wealth.

Lesson 7: The Rich Pay Themselves First

The rich prioritize saving and investing before they spend their money. They understand that by paying themselves first, they are investing in their future financial security. This principle is often referred to as "paying yourself first," and it is a key habit of the wealthy. By saving and investing regularly, the rich are able to accumulate wealth over time and achieve financial independence.