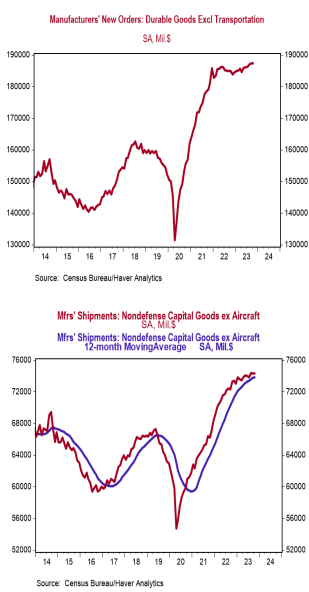

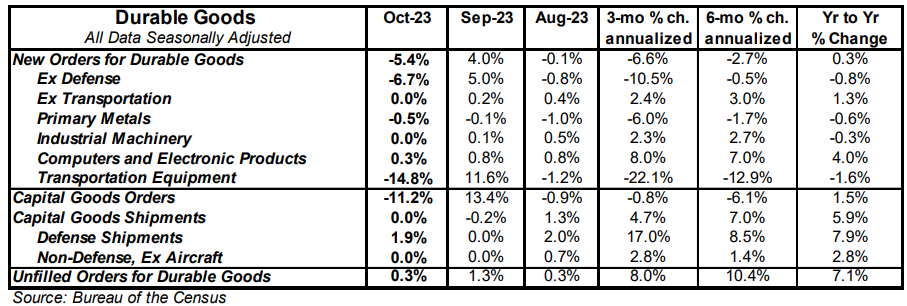

- New orders for durable goods fell 5.4% in October (-5.9% including revisions to prior months), lagging the consensus expected -3.2%. Orders excluding transportation were unchanged (-0.3% including revisions), versus a consensus expected +0.1%. Orders are up 0.3% from a year ago, while orders excluding transportation have risen 1.3%.

- Commercial aircraft dominated the drop in October. Orders for autos and primary metals declined as well, with gains in fabricated metal products and computers & electronic products.

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure was unchanged in October. If unchanged in November and December, these shipments will be up at a 0.9% annualized rate in Q4 versus the Q3 average.

- Unfilled orders rose 0.3% in October and are up 7.1% in the past year.

Implications: Durable goods orders fell in October after a September surge as the typically volatile transportation category continues to swing monthly readings. Commercial aircraft orders plummeted 49.6% in October following a surge in September. Meanwhile orders for autos fell 3.8%. Strip out the typically volatile transportation category and orders for durable goods were unchanged in October. Excluding transportation, rising orders for fabricated metal products (+0.4%) and computers & electronic products (+0.3%) were offset by declines in orders for primary metals (-0.5%) and electrical equipment (-0.1%). New orders for machinery were unchanged in October. Arguably the most important number in today’s report is core shipments – a key input for business investment in the calculation of GDP – which was unchanged in October. If unchanged in November and December as well, these shipments would rise at a 0.9% annualized rate in Q4 versus the Q3 average, continuing the trend in slowing business investment that started in Q1 2022 and has slowed in every quarter since. We expect this trend will continue as the economy feels the lagged effects of the Federal Reserve’s actions to tighten monetary policy. In the past year, orders for durable goods are up a tepid 0.3%, while orders excluding transportation are up 1.3%. A number of factors are likely to keep the path forward rocky as we close out 2023: restrictive monetary policy from the Federal Reserve, the tightening of lending standards following stress in the banking sector, and withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending. In addition, the return toward services likely means goods-related activity will continue to soften in the year ahead, even as some durables that facilitate services recover. While the data to-date have shown continued economic growth, we believe a recession is likely before the end of 2024. In other news this morning, initial claims for jobless benefits fell 24,000 last week to 209,000. Meanwhile, continuing claims fell 22,000 to 1.840 million. These figures suggest continued growth in employment in October.