View from the Observation Deck

Today’s blog post compares the performance of energy-related stocks to the broader market, as measured by the S&P 500 Index, over an extended period. Given that most developed and developing economies are dependent on oil, natural gas, and electricity for their growth, the prices of those commodities often (but not always) influence the valuations of companies involved in those sectors. Click here to view our last post on this topic.

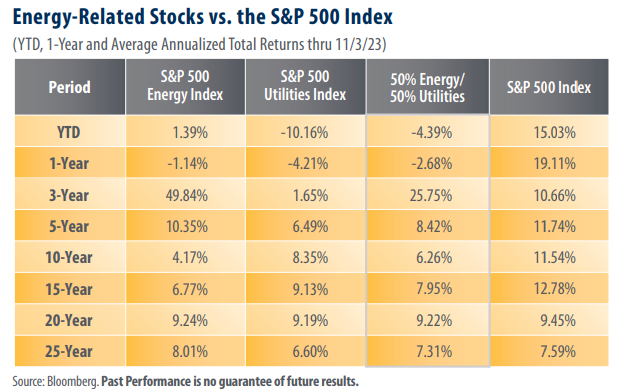

The S&P 500 Energy Index (Energy Index) outperformed the broader S&P 500 Index in just two of the eight time frames represented in today’s table. For comparison, the S&P 500 Utilities Index (Utilities Index) has underperformed the S&P 500 Index in all eight of the periods.

Energy company valuations frequently exhibit a high correlation to the price movements of their underlying commodity, while the valuations of utilities companies often fluctuate based on prevailing interest rates. From our perspective, the recent total returns of energy and utility stocks continue to reflect these associations. The price of a barrel of WTI crude oil rose by 0.31% on a YTD basis through 11/3/23. For comparison, the S&P 500 Energy Index increased by 1.39% on a total return basis over the same period. Similarly, the federal funds target rate (upper bound) stood at 5.50% on 10/31/23, up from 4.50% on 12/30/22. As the table reveals, the Utilities Index responded with a decline of 10.16% on a total return basis YTD through 11/3/23.

The Price to Earnings (P/E) multiples for the S&P 500 and Utilities Indices stand above their 20-year averages, while the P/E ratio for the Energy Index sits well-below its 20-year average.

As of 11/3/23, the 2023 year-end P/E ratios for the S&P 500, Utilities, and Energy Indices stood at 20.01, 16.83, and 11.24, respectively. By contrast, the 20-year weekly average P/E ratios for those same indices stood at 18.36, 16.66, and 35.69, respectively, through 11/3/23. Energy and utilities stocks represented a combined weighting of approximately 6.93% of the S&P 500 Index as of 11/3/23, according to data from S&P Global. The estimated 2023 year-end P/E ratios for the S&P 500 Index, Utilities Index, and the Energy Index reflect year-over-year earnings growth estimates for 2023 of -3.19%, 6.6%, and -29.8%, respectively, as of 11/6/23.

Takeaway

With total returns of 65.43% and 1.56%, respectively, Energy and Utilities were the only S&P 500 Index sectors to post positive total returns in 2022 (not in table). Since then, they have underperformed the broader S&P 500 Index by a significant margin. In our view, crude oil price volatility and surging interest rates may offer insight into the recent underperformance in energy and utility companies. Earnings for the Utilities Index are forecast to remain positive for 2023. We don’t find this surprising given that most households will keep using their lights, air conditioning, stoves, and furnaces even if budgets are stretched and commodity prices fluctuate. Energy stocks, on the other hand, tend to be more volatile. Lower economic activity means fewer deliveries, trips to the store, and travel, which can have a negative effect on the earnings of energy companies.