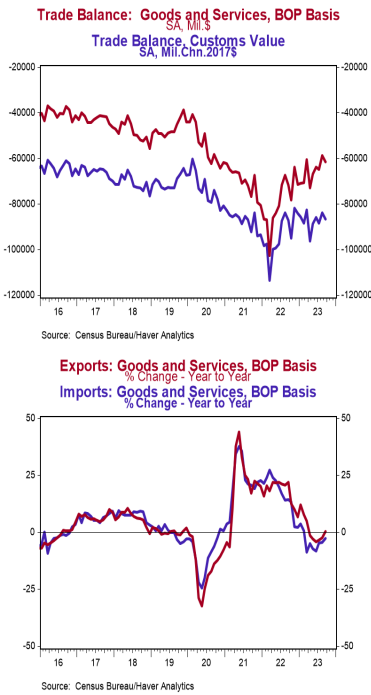

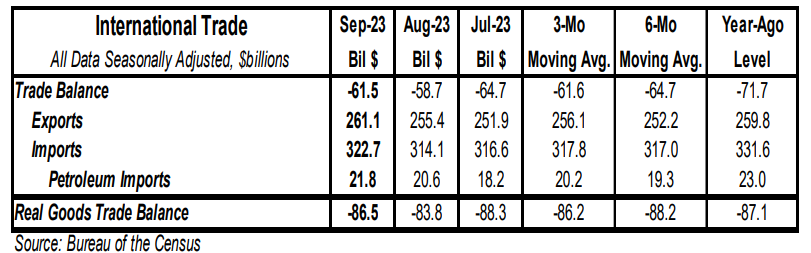

- The trade deficit in goods and services came in at $61.5 billion in September, larger than the consensus expected $59.8 billion.

- Exports rose by $5.7 billion, led by civilian aircraft and gem diamonds. Imports rose by $8.6 billion, led by cell phone & other household goods, autos, and crude oil.

- In the last year, exports are up 0.5% while imports are down 2.7%.

- Compared to a year ago, the monthly trade deficit is $10.2 billion smaller; after adjusting for inflation, the “real” trade deficit in goods is $0.6 billion smaller than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications: The trade deficit in goods and services grew to $61.5 billion in September as imports grew faster than exports. However, we prefer to focus on the total volume of trade, imports plus exports, as it shows the extent of business and consumer interaction across the US border. This measure exploded higher, expanding by $14.2 billion in September. However, it remains down 1.3% versus a year ago. Although the growth in September is positive, exports are only up 0.5% versus a year ago, while imports are still down 2.7%, consistent with our forecast that the US is headed toward a recession. And while a recent surge in the federal budget deficit might have helped the US economy avoid recession in the short-term, this kind of artificial support can’t last. Notably, there is a major shift going on in the pattern of US trade. So far this year, imports from China are down 24.3% year-to-date versus the same timeframe in 2022. China used to be the top exporter to the US. Now the top spot is held by Mexico, with Canada and China flip flopping month by month between second and third. Meanwhile, daily freight rates have fallen rapidly and are back down to pre-COVID levels, or lower, as demand for shipping has also weakened. This was confirmed by the New York Fed’s Global Supply Chain Pressure Index in September, with the index staying in negative territory, 0.70 standard deviations below the index’s historical average. Weaker demand coupled with an easing of parts shortages and less shipping congestion have pulled the indicator lower. Another positive in today’s report was the dollar value of US petroleum exports exceeding imports once again. This marks the 19th consecutive month of the US being a net exporter of petroleum products.