View from the Observation Deck

Investors directing capital into mutual funds and exchange traded funds (ETFs) continued to favor passive investing over active management for the 12-month period ended 9/30/23.

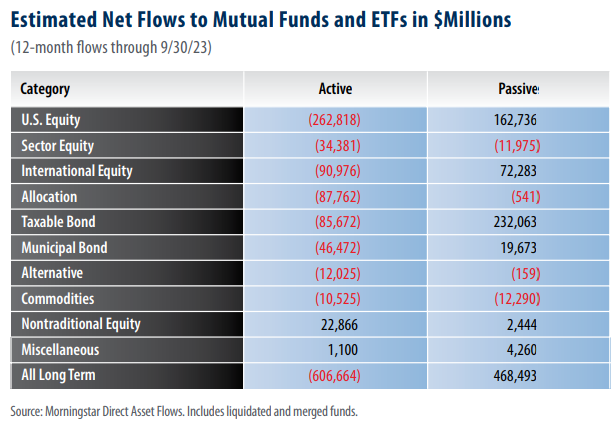

Passive mutual funds and ETFs reported estimated net inflows totaling $468.49 billion for the 12-month period ended 9/30/23 while active funds reported estimated net outflows totaling $606.66 billion over the same period. The only active categories over the past 12 months with net inflows were Nontraditional Equity and Miscellaneous with inflows of $22.87 billion and $1.10 billion, respectively (see table above). For comparison, the top three passive categories were Taxable Bond, U.S. Equity, and International Equity with inflows of $232.06 billion, $162.74 billion, and $72.28 billion, respectively.

Despite improving total returns throughout much of 2023, equity funds have seen significant outflows over the trailing 12-month period.

Combined, the active and passive equity categories experienced outflows of $228.12 billion for the 12-month period ended 9/30/23. For comparison, the Taxable and Municipal Bond categories reported net inflows totaling $119.59 billion over the same time frame. The S&P 500, S&P MidCap 400, and S&P SmallCap 600 Indices posted total returns of 21.59%, 15.46% and 9.98% respectively, for the 12-month period ended 9/29/23, according to Bloomberg. With respect to foreign equities, the MSCI Daily TR Net World (ex U.S.) and MSCI Emerging Net TR Indices posted total returns of 24.00% and 11.70%, respectively. The U.S. Dollar Index (DXY) fell by 5.30% for the same time frame. The index reflects the general international value of the dollar relative to a basket of major world currencies. The weaker dollar accelerated the performance of unhedged foreign securities held by U.S. investors, in our opinion.

Takeaway

Passive mutual funds and ETFs saw inflows of $468.49 billion compared to outflows of $606.66 billion for active funds over the trailing 12-month period ended 9/30/23. In the table above, we observe the largest disparity occurred in the U.S. Equity category, with active shedding $262.82 billion compared to inflows of $162.74 billion for passive funds. Notably, net outflows from equity funds stood at $228.12 billion over the trailing 12-months, while combined fixed income saw inflows of $119.59 billion. Nontraditional Equity and Miscellaneous were the only two categories to see inflows among the active management styles. To view the last time we updated this post, please click here.