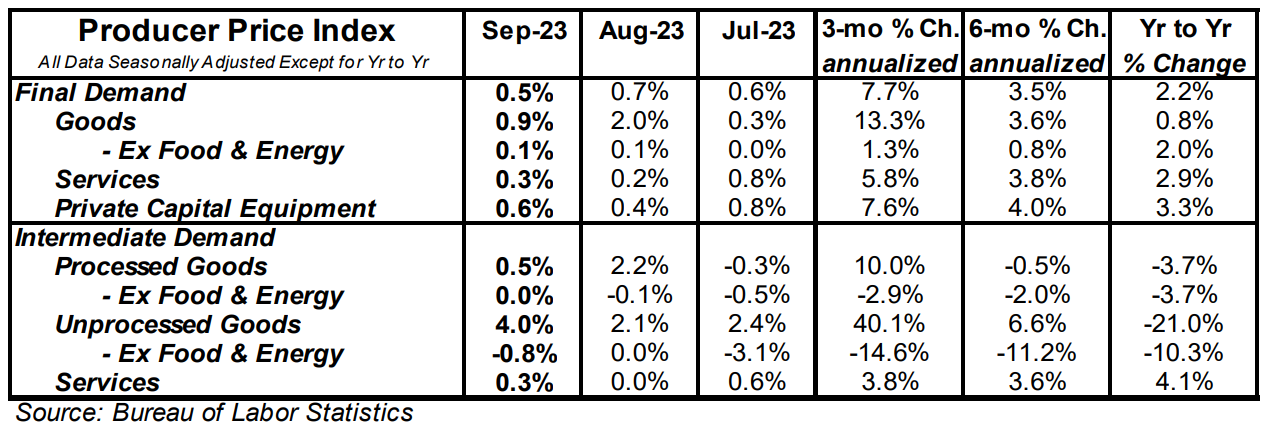

- The Producer Price Index (PPI) rose 0.5% in September, coming in above the consensus expected +0.3%. Producer prices are up 2.2% versus a year ago.

- Energy prices rose 3.3% in September, while food prices increased 0.9%. Producer prices excluding food and energy rose 0.3% in September and are up 2.7% versus a year ago.

- In the past year, prices for goods are up 0.8%, while prices for services have risen 2.9%. Private capital equipment prices rose 0.6% in September and are up 3.3% in the past year.

- Prices for intermediate processed goods rose 0.5% in September but are down 3.7% versus a year ago. Prices for intermediate unprocessed goods rose 4.0% in September but are down 21.0% versus a year ago.

Implications:

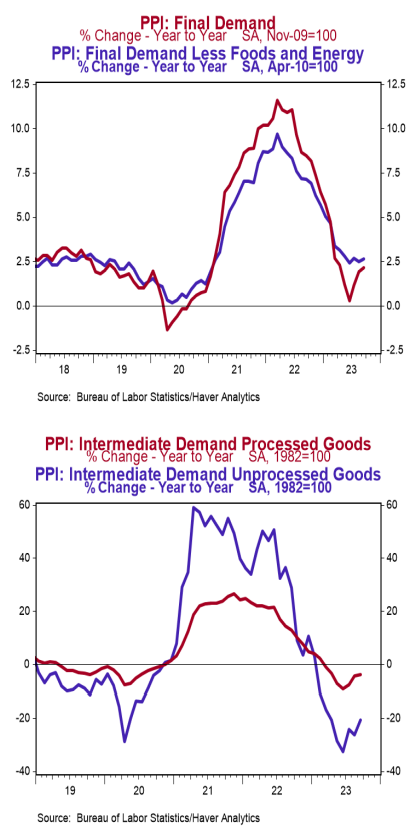

Producer prices jumped 0.5% in September following large increases in July and August, reminding the Fed that the inflation fight is still far from over. As you can see from the nearby chart, the year-ago comparison for producer prices, now up 2.2%, has fallen considerably since the 11.7% peak in March 2022. Keep in mind, though, that much of the moderation is due to outsized jumps in inflation immediately after the invasion of Ukraine last year, which are now rolling off year-ago calculations. Inflation has re-accelerated of late, with producer prices up 7.7% at an annualized rate in the last three months. Taking a look at the details of today’s report shows that “core” prices – which excludes the typically volatile food and energy components – rose 0.3% in September and are up 2.7% in the past year. Here too, prices are accelerating, with core inflation up at a 4.5% annualized rate over the past three months. The goods sector led prices higher in September, rising 0.9% on the back of higher energy costs. Strip out energy, and goods prices rose a more modest 0.3%. Services prices rose 0.3% in September as higher costs for margins received by wholesalers were tempered by a decline in prices for transportation and warehousing. Prices further back in the pipeline have also accelerated of late. Intermediate demand processed goods prices rose 0.5% in September following a 2.2% rise in August. That said, these prices are down 3.7% in the past year. Meanwhile unprocessed goods prices rose 4.0% in September following 2.0%+ increases in both July and August. Despite the recent jumps, these prices remain down 21.0% in the past year. While modest core inflation readings for producer prices are welcome, data from the CPI reports (September data out tomorrow morning) continue to show that the Fed hasn’t reached the finish line.