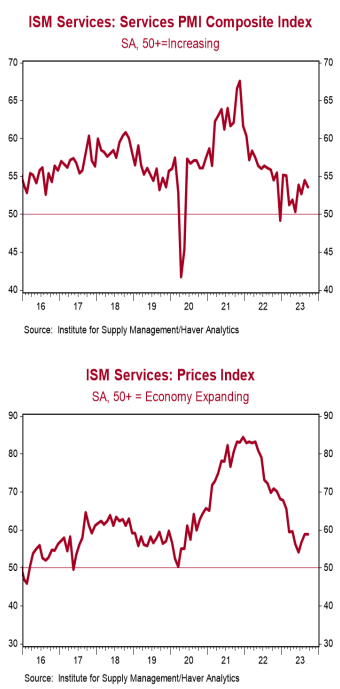

- The ISM Non-Manufacturing index declined to 53.6 in September, narrowly beating the consensus expected 53.5 (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in September. The business activity index rose to 58.8 from 57.3, while the new orders index dropped to 51.8 from 57.5. The employment index declined to 53.4 from 54.7, while the supplier deliveries index rose to 50.4 from 48.5.

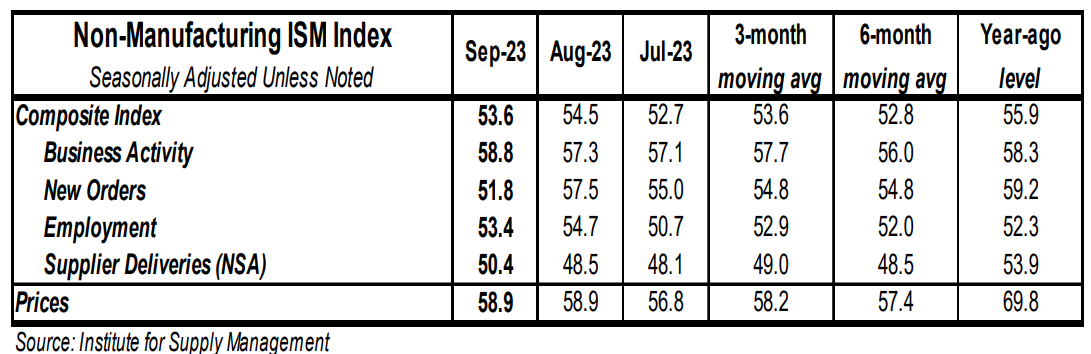

- The prices paid index remained unchanged at 58.9 in September.

Implications:

Still no sign of a recession in the service sector as activity continued to expand in September, narrowly beating consensus expectations, with thirteen of eighteen major industries reporting growth. Contrast this with the September ISM report on the manufacturing sector – where activity contracted for the eleventh month in a row and only five industries reported growth – output has clearly been shifting back toward services following the COVID-era when goods-related activity was artificially boosted. Looking at the details of today’s report, there was a notable drop in the new orders index from 57.5 in August to 51.8 in September. However, that category, along with its forward-looking counterpart – business activity – continued to expand in September and have done so each month of the year so far. Survey comments cited a stable business environment and were cautiously optimistic for solid performance as we close out 2023. Meanwhile, the labor market in the service sector remains competitive, with the index for employment expanding for the fourth consecutive month. Respondent comments continue to signal that a lack of supply, not demand, has been the problem for hiring in the service sector. Also notable in today’s report, the index for supplier deliveries expanded (albeit slightly) in September for the first time in ten months, signaling longer lead times for businesses. Finally, the highest reading out of any of the categories continues to come from the prices index, which remained unchanged at 58.9 in September. Inflation remains a problem for businesses in the service sector, with twelve out of eighteen major industries reported paying higher prices in the month. We expect the services sector to keep inflation trending above the Fed’s 2.0% target for some time. As for the economy, even though services are still expanding, we continue to believe a recession is on the way. Equity investors should remain cautious as we navigate these unprecedented times. In employment news this morning, ADP’s measure of private payrolls increased 89,000 in September versus a consensus expected 150,000. We expect Friday’s payroll report to show a nonfarm payroll gain of 160,000. In other recent news, cars and light trucks were sold at a 15.7 million annual rate in September, up 2.1% from August and up 14.3% from a year ago.