View from the Observation Deck

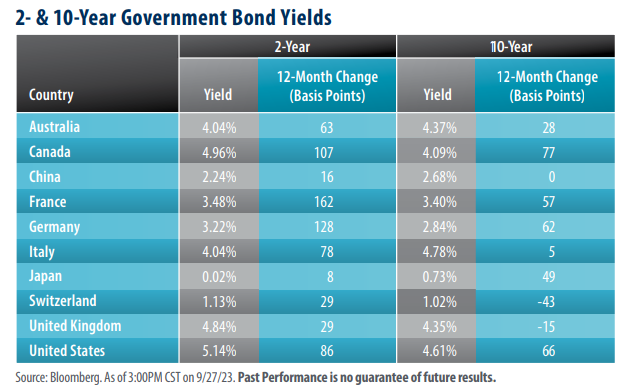

We update today’s table on a regular basis to show the effect monetary policy could be having on government bond yields. As many investors are aware, global central banks have been tightening monetary policy as they battle stubbornly high inflation, leading to increased yields. In the U.S., for example, the Federal Reserve increased the federal funds target rate (upper bound) eleven times, from 0.25%, where it stood on 3/15/22, to 5.50% on 7/26/23. Despite higher policy rates, headline inflation remains elevated above target rates in eight of the ten countries listed in today’s table (China and Switzerland being the only exceptions).

The yield curve between the 10-Year Treasury Note (T-note) and the 2-Year T-note remains inverted in the U.S.

Historically, an inverted yield curve has been a fairly accurate indicator of an impending economic recession. Data from the Federal Reserve Bank of San Francisco shows that an inverted yield curve has been a precursor to each of the last 10 economic recessions in the U.S. since 1955. As of 9/27/23, the yield on the 2-year T-note sits 53 basis points (bps) above the yield on the 10-year T-note (see table).

Negative real yields on government bond issues remain the rule rather than the exception.

As shown in the columns marked “12-Month Change (Basis Points)”, yields on most of the government bonds in today’s table reflect increases over the past 12-months. That said, even though policy rates and yields have risen, just three of the ten countries represented in today’s table have a positive real yield (yield minus inflation) on their 10-year note. As of 9/27/23, the three countries and their respective real yields were as follows: China (2.58%); the U.S. (0.91%); and Canada (0.09%). Click here to view our post from 8/22/23, where we wrote about the real yield on the 10-year T-note in more detail.

Takeaway

Despite the tighter monetary policies enacted by central banks around the world, inflation remains stubbornly high. Just two of the countries in today’s table have headline inflation readings that are below their stated target rate (China and Switzerland). The impact of higher interest rates on bond yields has been notable, with most of the countries in today’s table experiencing year-over-year yield growth. That said, the real yields of these countries continue to reflect the impact of inflation. As mentioned above, real yields on the 10-year government bond issues are negative for seven of the ten countries represented in the table, with China, the U.S., and Canada being the only exceptions.