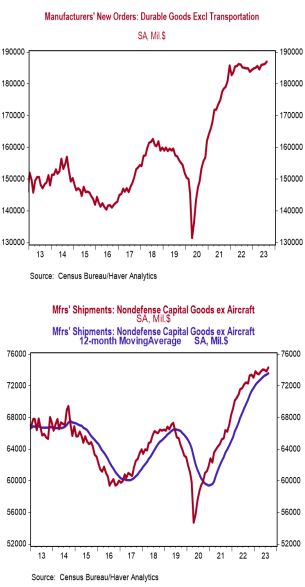

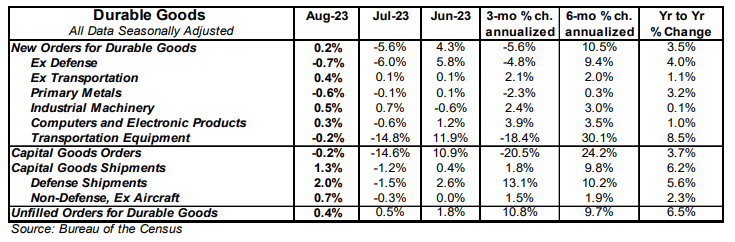

- New orders for durable goods rose 0.2% in August (-0.3% including revisions to prior months), beating the consensus expected -0.5%. Orders excluding transportation rose 0.4% (+0.1% including revisions), versus a consensus expected +0.2%. Orders are up 3.5% from a year ago, while orders excluding transportation have risen 1.1%.

- Rising orders for defense aircraft, autos, and machinery led gains across most major categories.

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure rose 0.7% in August. If unchanged in September, these shipments will be up at a 1.1% annualized rate in Q3 versus the Q2 average.

- Unfilled orders rose 0.4% in August and are up 6.5% in the past year.

Implications:

Durable goods orders surprised to the upside in August, with growth across most major categories. The only notable weakness came from commercial aircraft, where a June surge in orders has tempered over the past two months. The decline for commercial aircraft orders (-15.9%) in August was partially offset in the transportation category by rising orders for defense aircraft and motor vehicles & parts. Strip out the typically volatile transportation category and orders for durable goods rose a moderate 0.4% in August, with gains across most major categories. Machinery led ex-transportation orders higher, rising 0.5% in August, while fabricated metal products (+0.5%), electrical equipment (+1.1%), and computers & electronic products (+0.3%) also rose. Primary metals products was the lone major category to decline outside the transportation sector, down 0.6%. Arguably the most important number in today’s report is core shipments – a key input for business investment in the calculation of GDP – which rose 0.7% in August. If unchanged in September, core shipments would rise at a 1.1% annualized rate in Q3 vs the Q2 average. Core shipment growth has been slowing since the start of 2022, and we expect that this trend will continue as the economy feels the lagged effects of the Federal Reserve’s actions to remove money from the system. In the past year, orders for durable goods are up 3.5%, while orders excluding transportation are up a more modest 1.1%. But when you consider that producer prices for capital equipment are up 3.8% in the past year, it means that orders have declined when adjusted for inflation. A number of factors are likely to keep the path forward rocky as we close out 2023: a tighter Federal Reserve, the tightening of lending standards following stress in the banking sector, and withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending. In addition, the return toward services means a large portion of goods-related activity will soften in the year ahead, even as some durables that facilitate services recover. While the data to-date have shown continued economic growth, we believe a recession is likely before the end of 2024. Finally, we got data on the M2 money supply yesterday which declined 0.2% in August, and is down 3.7% from a year ago. Monetary policy operates with a lag, and we are likely to feel the negative economic effects of these declines in the months ahead.