View from the Observation Deck

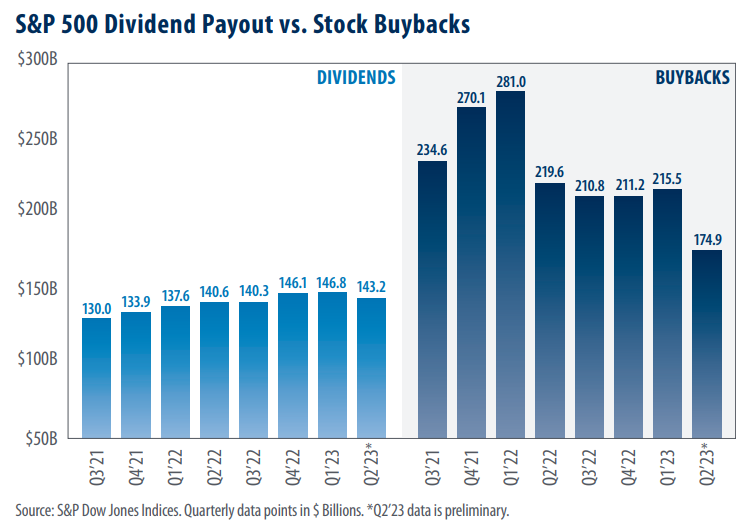

Companies have a number of ways to return capital to their shareholders. Two of the more popular methods in recent

years are cash dividends and stock buybacks. We update today’s post on a quarterly basis to provide insight regarding

the trend in cash dividends and stock buybacks among the companies that comprise the S&P 500 Index (“Index”).

• Quarterly cash dividends and stock buybacks totaled $143.2 billion and $174.9 billion, respectively, in Q2’23,

according to data from S&P Dow Jones Indices.

• The all-time high for the Index’s quarterly dividend payout was the $146.8 billion distributed in Q1’23. For

comparison, the all-time high for stock buybacks was the $281.0 billion of share repurchases in Q1’22.

• In total, the companies that comprise the Index distributed $812.5 billion in dividends over the trailing

12-month period ended June 2023, down from $1.005 trillion for the same time frame ended June 2022.

• Total shareholders return of dividends and buybacks stood at $1.389 trillion over the trailing 12-month period

ended June 2023.

• The S&P 500 Index sectors that were most aggressive in repurchasing their stock in Q2’23 were as follows (% of

all stocks repurchased): Information Technology (26.95%); Financials (18.72%); and Communication Services

(14.50%), according to S&P Dow Jones Indices.

Takeaway

As indicated in today’s chart, both cash dividends and stock buybacks fell on a quarter-over-quarter basis

in Q2’23. Over the twelve-month period ended June 2023, shareholder returns of dividends and share

repurchases totaled $1.389 trillion, down from the record $1.547 trillion over the twelve-month period ended

June 2022. Notably, the largest 20 companies in the index accounted for 52.0% of all buybacks in Q2’23, above

the historical average of 47.2%, according to S&P Dow Jones Indices. Given the backdrop of tighter monetary

policy, the threat of an economic recession in the U.S., and estimates that the companies that comprise the S&P

500 Index may experience negative earnings growth this year, it does not surprise us to see smaller companies

find other uses for excess capital aside from buybacks. That said, dividend distributions remained relatively

consistent over the time frame above. In our view, this is to be expected. Generally, companies tend to avoid

cutting their dividend, as the action can be seen as an indication of financial weakness.