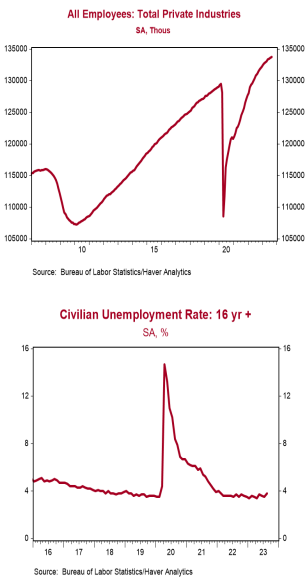

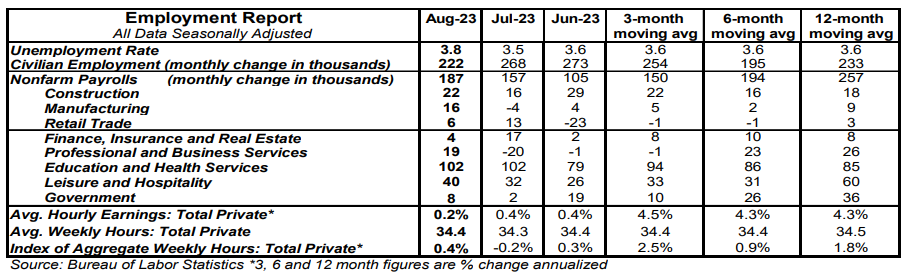

- Nonfarm payrolls increased 187,000 in August, narrowly beating the consensus expected 170,000. Payroll gains for June and July were revised down by a total of 110,000, bringing the net gain, including revisions, to 77,000.

- Private sector payrolls rose 179,000 in August but were revised down by 59,000 in prior months. The largest increase in August was for education & health services (+102,000) and leisure & hospitality (+40,000). The largest decline was in truck transportation (-37,000). Manufacturing increased 16,000 while government rose 8,000.

- The unemployment rate rose to 3.8% in August from 3.5% in July.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.2% in August and are up 4.3% versus a year ago. Aggregate hours rose 0.4% in August and are up 1.8% from a year ago.

Implications:

Continued improvement in the labor market, but with plenty of ammunition for the Federal Reserve to skip a rate hike in September. Nonfarm payrolls rose 187,000 in August while civilian employment, an alternative measure of jobs that includes small-business start-ups increased 222,000. Both of these are healthy, but downward revisions to June and July trimmed payrolls by 110,000, bringing the net gain to 77,000. This, in turn, will boost the argument for skipping or pausing by the doves at the Fed. Although truck transportation declined 37,000, that drop was due to the dissolution of Yellow Trucking and is unlikely to be repeated next month. The strongest part of the report was total hours worked in the private sector rising 0.4% in August, the most for any month since January. Although the headline unemployment rate spiked up to 3.8% from 3.5% in July, the gain was due to a 736,000 increase in the labor force (people who are either working or looking for work). As a result, the participation rate increased to 62.8%, the highest since before COVID. An increase in the labor force is also good news for monetary doves because it could make it easier for employers to find workers at any given “real” (inflation-adjusted) wage rate. On that note, average hourly earnings rose a tepid 0.2% in August, which, given the surge in oil prices, will substantially lag inflation for the month. Still, recent slow wage growth may also have been influenced by layoffs at Yellow Trucking and average hourly earnings are up 4.3% versus a year ago. With the Fed stuck on Keynesian models, it’s hard to imagine that it thinks we are heading toward 2.0% inflation when wages are rising 4.3%. The Fed is probably looking for wage growth to slow to 3.0 - 3.5% before they get comfortable with a 2.0% inflation forecast. The Fed is now very likely to skip September, but we think markets are underestimating the odds of a (potentially last) rate hike in November. We expect continued job growth for the next few months, but also foresee a weakening and recessionary labor market starting late this year or in early 2024.