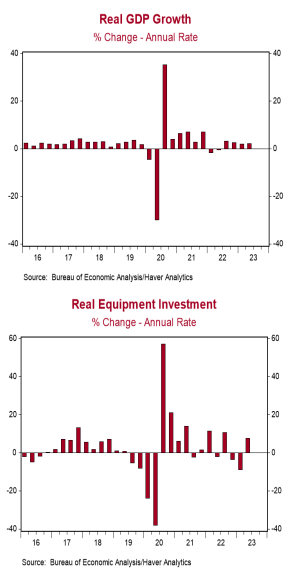

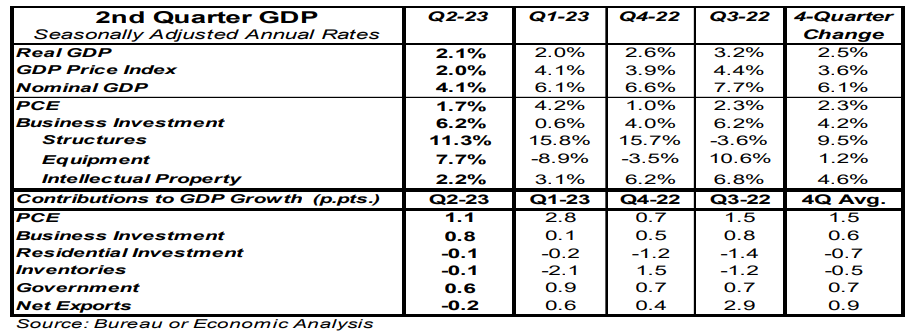

- Real GDP growth in Q2 was revised lower to a 2.1% annual rate from a prior estimate of and consensus expected 2.4%.

- Downward revisions to inventories, business investment, and net exports more than offset an upward revision to government purchases.

- Personal consumption, business fixed investment, and home building, combined, rose at a 2.1% annual rate in Q2. We refer to this as “core” GDP.

- The GDP price index was revised lower to a 2.0% annual growth rate from a prior estimate of 2.2%. Nominal GDP growth – real GDP plus inflation – was revised lower to a 4.1% annualized rate from a prior estimate of 4.7%.

Implications:

Real GDP was revised downward for the second quarter to a 2.1% annual rate from a prior estimate of 2.4%. The lower revision to the overall number was due to the cumulative effect of a series of small downward revisions to inventories, business investment, and net exports. More important, today we also received our first look at economy-wide corporate profits for the second quarter, which declined 0.4% versus Q1, and are down 6.5% from a year ago. However, the government includes Federal Reserve profits in these data, and the Fed has recently been generating unprecedented losses. We follow profits excluding those earned (or lost) by the Fed, which were up 1.1% in the second quarter and up 3.8% from a year ago. In effect, the losses by the Fed are the private banking sector’s gain, as the Fed pays banks about 5.4% to hold reserves and do nothing with them. Still, plugging non-Fed profits into our Capitalized profits model suggests stocks are overvalued. Moving forward, we expect declines in corporate profits as the economy continues to re-normalize after the massive fiscal and monetary shocks of 2020-21. In turn, this will be a headwind for equities. In addition to corporate profits, we also got a Q2 total for Real Gross Domestic Income, an alternative to GDP that is just as accurate. Real GDI grew at only a 0.5% annual rate in Q2 and is down 0.5% versus a year ago, consistent with underlying economic weakness. These are figures that are normally seen in and around recessions. Regarding monetary policy, inflation continued to moderate in the second quarter, before the recent spike in oil prices. GDP inflation was revised lower to a 2.0% annual rate in Q2 versus a prior estimate of 2.2%. GDP prices are up 3.6% from a year ago, still higher than the Fed’s 2.0% target. Meanwhile, nominal GDP (real GDP growth plus inflation) rose at a 4.1% annual rate in Q2 and is up 6.1% from a year ago. In employment news this morning, ADP’s measure of private payrolls increased 177,000 in August versus a consensus expected 195,000. We expect Friday’s payroll report to show a nonfarm patrol gain of 160,000. In recent housing news, home prices are showing consistent gains after a drop late last year. The national Case-Shiller index rose 0.7% in June while the FHFA index rose 0.3%. Notably, while the Case-Shiller index is still down from its peak in June last year, the FHFA index is now at a new all-time high.