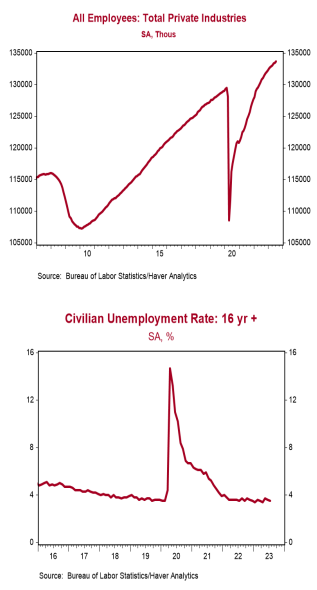

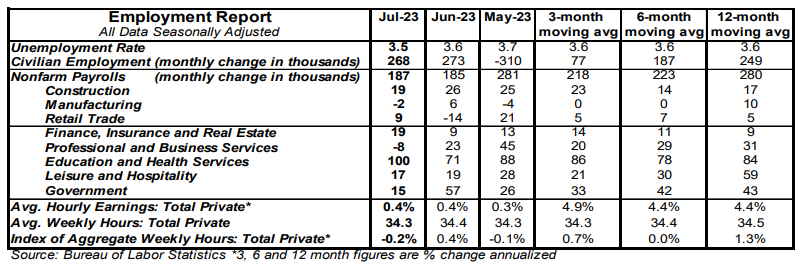

- Nonfarm payrolls increased 187,000 in July, narrowly lagging the consensus expected 200,000. Payroll gains for May and June were revised down by a total of 49,000, bringing the net gain, including revisions, to 138,000.

- Private sector payrolls rose 172,000 in July and were revised down by 25,000 in prior months. The largest increase in July was for education & health services (+100,000), with smaller gains in a wide range of other categories, including other services, construction, financial activities, wholesale trade, and leisure & hospitality. Manufacturing declined 2,000 while government rose 15,000.

- The unemployment rate ticked down to 3.5% in July from 3.6% in June.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.4% in July and are up 4.4% versus a year ago. Aggregate hours declined 0.2% in July and are up 1.3% from a year ago.

Implications:

Mixed data today on the job market. Some signs of softness, but strength enough in the non-headline numbers to keep the market guessing about the Fed. Nonfarm payrolls rose 187,000 in July, slightly below consensus expectations and the second consecutive month below 200,000, the first time that’s happened since the onset of COVID. In addition, payroll gains in prior months were revised down by 49,000. Meanwhile, total hours worked in the private sector declined 0.2% in July as the average workweek ticked down to 34.3 hours from 34.4 in June. If these were the only data the Federal Reserve looked at, it would be easy to pencil-in another “pause” or “skip” at the September meeting. But the other figures on the employment situation in July were not what the Fed is looking for. Civilian employment, an alternative measure of jobs that includes small-business start-ups, rose 268,000 in July, which helped push the unemployment rate down to 3.5%. As recently as June the Fed had projected that the jobless rate would average 4.1% in the fourth quarter, which now looks unlikely and, in turn, that should mean a more aggressive Fed. Average hourly earnings rose 0.4% in July and are up 4.4% from a year ago. With the Fed stuck on Keynesian models, it’s hard to imagine that it thinks we are heading toward 2.0% inflation when wages are rising 4.4%. The Fed is probably looking for wage growth to slow to 3.0 - 3.5% before they get comfortable with a 2.0% inflation forecast. This is yet another reason that investors should not think rate hikes are over. The drop in the M2 measure of the money supply since early 2022 is gaining traction, but gradually, as the remnants of the M2 surge in 2020-21 are still working their way through the system. We expect continued job growth for the next few months, but also foresee a weakening and recessionary labor market starting late this year or in early 2024.