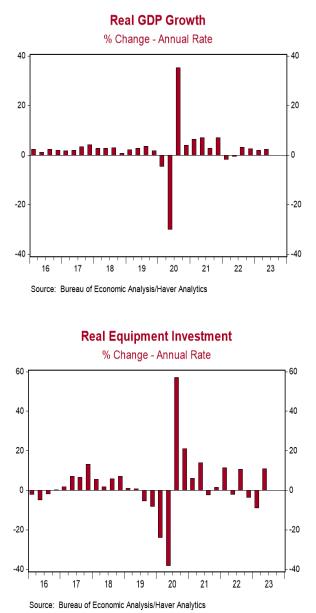

- Real GDP increased at a 2.4% annual rate in Q2, beating the consensus expected 1.8%.

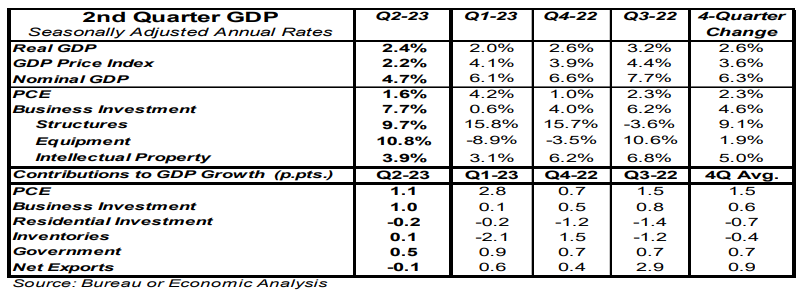

- The largest positive contributions to real GDP growth in Q2 came from personal consumption and business fixed investment, including equipment, commercial construction, and intellectual property. Government purchases also added to GDP while home building and international trade were small drags.

- Personal consumption, business fixed investment, and home building, combined, rose at a 2.3% annual rate in Q2. We refer to this as “core” GDP.

- The GDP price index increased at a 2.2% annual rate in Q2 and is up 3.6% from a year ago. Nominal GDP (real GDP plus inflation) rose at a 4.7% annual rate in Q2 and is up 6.3% from a year ago.

Implications:

There was much to like in today’s report on second quarter GDP, but that doesn’t mean the risk of a recession has gone away. Real GDP grew at a 2.4% annual rate in Q2, beating consensus expectations. The growth in Q2 was led by consumer spending and business fixed investment, with all three major categories of business investment higher: equipment, commercial construction, and intellectual property (think research and development). Government purchases also accounted for some GDP growth while home building and net exports suffered small declines. We like to focus on “Core” GDP, which includes consumer spending, business fixed investment, and home building, while excluding government purchases, inventories, and international trade, all of which are very volatile from quarter to quarter. Core GDP increased at a 2.3% annual rate in Q2, very close to the growth rate for overall Real GDP. Does this mean a recession is off the table? No, it doesn’t. The lags between monetary policy and its effects on the economy are long and variable and we still believe a recession will hit late this year or in the first half of 2024. Figures on Gross Domestic Income for Q2 don’t arrive for another month, but, through Q1, were noticeably lagging Real GDP growth. Ultimately GDI and GDP should equal each other but they are based on different sources and so are rarely exactly the same. We bring this up because, over time, GDI has been just as accurate as GDP in assessing the overall performance of the economy. We’ll be watching GDI closely when those figures get reported next month. In the meantime, monetary policy has gained some traction against inflation. GDP prices were up at a 2.2% annual rate in Q2, the slowest gain since the onset of COVID in 2020. Nominal GDP, which is Real GDP growth plus inflation, increased at a 4.7% annual rate in Q2, also the slowest since the onset of COVID, but is still up 6.3% from a year ago. Continued Real GDP growth is good news, but (recent) past performance is no guarantee of continued growth.