View from the Observation Deck

Investors often use the level of cash held by companies, among other metrics, as a barometer of financial strength. Corporations, however, desire to earn a return on their capital, and holding cash in excess of what is needed to fund short-term operations could prove to be detrimental to their ability to do so. The level of cash required for operations will vary from company to company, but a high-level view of the total cash holdings for companies that comprise an index may offer unique insight into the overall business climate, in our opinion. Bear in mind that S&P 500 companies also utilize cash for such things as mergers and acquisitions (M&A), investment in plants and factories, and to purchase software and equipment.

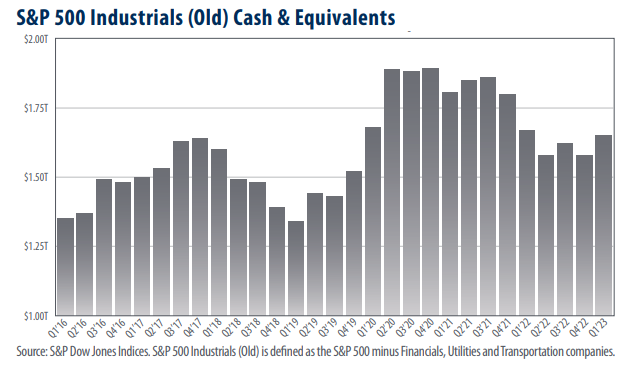

• Total cash and cash equivalents for the companies that comprise the S&P 500 Industrials (Old) Index stood at $1.65 trillion at the end of Q1’23, down $240 billion from the record of $1.89 trillion, set in Q4’20 during the height of the COVID-19 pandemic. For comparison, cash and cash equivalents are up from $1.58 trillion in Q4’22

(see chart).

• From 3/31/09 to 3/31/23, the companies that comprise the S&P 500 Index distributed $5.4 trillion in stock dividends and spent a staggering $8.0 trillion on stock buybacks, according to data from S&P Dow Jones Indices.

• The S&P 500 Index posted an average annual total return of 14.65% over the same time frame.

Indicative of a massive divestment of cash, stock buybacks rose by 4.6% year-over-year from $881.7 billion in 2021, to a record $922.7 billion in 2022, according to S&P Dow Jones Indices. The companies that comprise the S&P 500 Index repurchased $215.5 billion (preliminary results) of their stock through the first quarter of 2023, down from $281.0 billion in Q1’22, but up from $211.9 billion in 4Q’22. After totaling a record $564.6 billion in 2022, dividend payments continued to grow. In Q1’23, total dividend payments for the S&P 500 Index stood at $146.8 billion, up from $137.6 billion in Q1’22 and up from $146.1 billion in Q4’22.

Takeaway

We believe that fluctuations in cash and cash equivalents may provide investors with unique insight into the overall business climate. As indicated in today’s chart, total cash and cash equivalents for the companies that comprise the S&P 500 Industrials (Old) Index stood at $1.65 trillion in Q1’23, down from the record-high of $1.89 trillion set in Q4’20, but up from $1.58 trillion in Q4’22. After a record-setting year in 2022, stock buybacks and dividend distributions continued their growth, coming in at $215.5 billion (preliminary results) and $146.8 billion, respectively, in Q1’23. We think the continued strength of buybacks and dividends could be viewed as a vote of confidence by corporations in their ability to weather current economic headwinds. Time will tell!