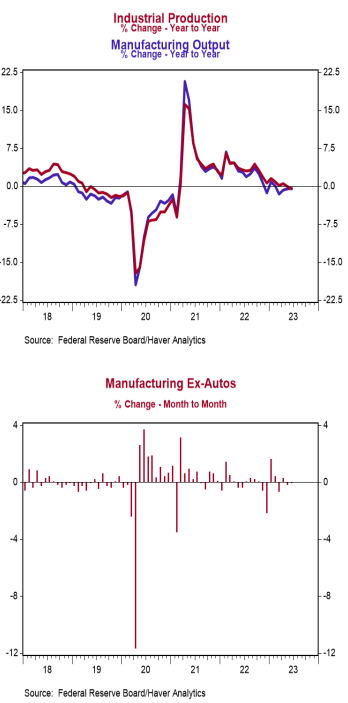

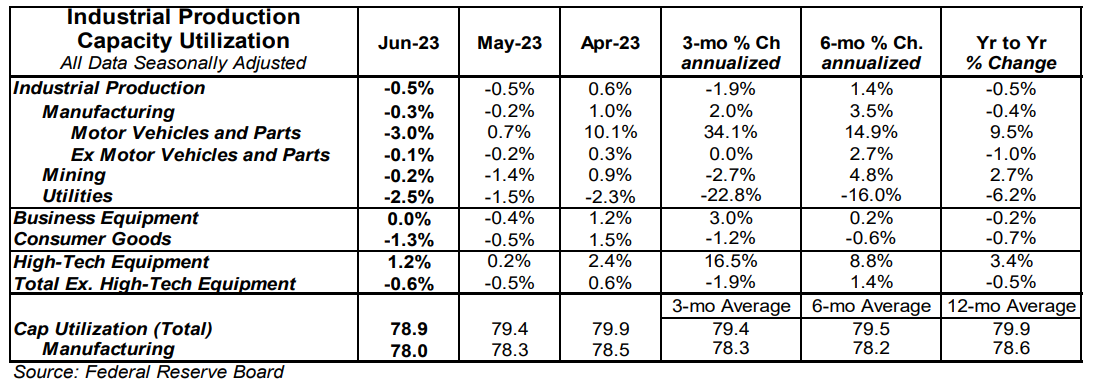

- Industrial production declined 0.5% in June (-0.8% including revisions to prior months) versus a consensus expectation of 0.0%. Utilities output fell 2.5% in June, while mining declined 0.2%.

- Manufacturing, which excludes mining/utilities, declined 0.3% in June. Auto production fell 3.0%, while non-auto manufacturing dropped 0.1%. Auto production is up 9.5% in the past year, while non-auto manufacturing is down 1.0%.

- The production of high-tech equipment rose 1.2% in June and is up 3.4% versus a year ago.

- Overall capacity utilization fell to 78.9% in June from 79.4% in May. Manufacturing capacity utilization declined to 78.0% in June from 78.3%.

Implications:

Industrial production declined in June, falling for the second month in a row with every major category contributing to the drop. The biggest source of weakness in June came from the manufacturing sector where activity fell 0.3%. Looking at the details, both auto and non-auto manufacturing posted declines, dropping 3.0% and 0.1%, respectively. Given the trend of consumers shifting their preferences back toward services and away from goods, we expect manufacturing activity to continue to weaken in future months. We are still forecasting a recession ahead with the goods sector leading the way. The utilities sector (which is volatile and largely dependent on weather) was another drag on the headline number in June, posting a decline of 2.5%. Lastly, output in the mining sector declined 0.2%. Less drilling of new oil wells more than offset gains in oil and gas extraction in June. Given that the mining index remains below its pre-pandemic highs, we expect this series to be a lifeline for industrial production in the near term. In other recent factory news, the Empire State Index, a measure of New York factory sentiment, fell to +1.1 in July from +6.6 in June. We also got data on the NAHB Housing Index this morning, a measure of homebuilder sentiment, which rose to 56 in July from 55 in June. This is the seventh consecutive gain and the highest reading in over a year. An index reading above 50 signals that a greater number of builders view conditions as good versus poor and that sentiment is now positive following nearly a year of pessimism due to rapidly rising mortgage rates. Many owners of existing homes are holding their homes dear because of having locked-in long-term fixed mortgages at sub-3% rates before 2022. As a result, prospective homebuyers are turning to the new home market, buoying builder optimism.