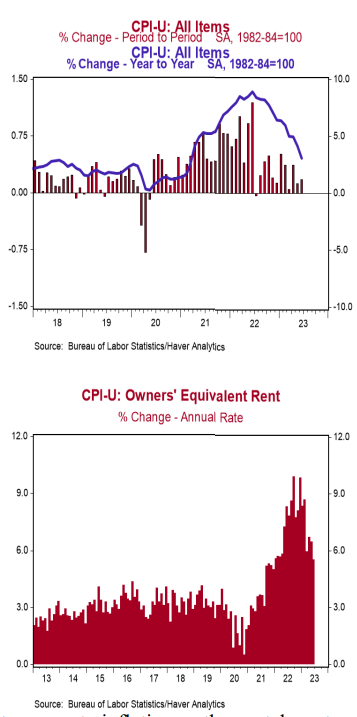

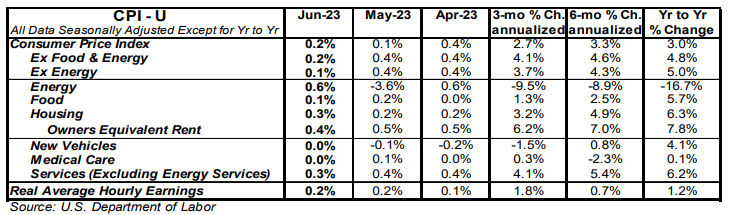

- The Consumer Price Index (CPI) rose 0.2% in June, below the consensus expected +0.3%. The CPI is up 3.0% from a year ago.

- Energy prices rose 0.6% in June, while food prices rose 0.1%. The “core” CPI, which excludes food and energy, rose 0.2% in June, below the consensus expected +0.3%. Core prices are up 4.8% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.2% in June and are up 1.2% in the past year. Real average weekly earnings are up 0.6% in the past year

Implications:

There was more progress in the battle against inflation in June, but don’t expect that to change the likelihood of a Fed rate hike later this month. Consumer prices rose 0.2% in June, coming in below the consensus expected 0.3%, and pushing the twelve-month change down to 3.0%. On the surface level it looks like inflation has been moderating rapidly recently, with year-to-year inflation dropping from 4.9% to 3.0% in the last two months. But, digging deeper, shows that this has more to do with outsized jumps in prices last year, with May and June 2022 inflation of 0.9% and 1.2%, respectively, rolling off the year-ago comparisons. As is often the case, the surge in inflation last year was followed by a lull, with prices barely budging in July and August 2022. That means we are likely to see the twelve-month inflation readings re-accelerate toward the end of the Summer. Couple that with a resilient US labor market, Powell and Co. still have plenty of reason to keep monetary policy tight in the months to come. Looking at the details of today’s report, energy and food prices both rose in June. Stripping out these two components shows “core” prices matched the 0.2% headline rise, while the twelve-month comparison declined to 4.8%. The main driver within the core categories was once again housing rents, which rose 0.5% in June. Even though rental inflation has been coming down from the back-breaking pace in the second half of 2022, rents for both actual tenants and the imputed rental value of owner-occupied homes are still running at or above a 6% annualized rate over three-, six-, and twelve-month timeframes. This is important because together they make up a third of the weighting in the overall index and have been major contributors to persistently high inflation over the last two years. We expect rents to continue to generate inflation as they catch up to home prices, which skyrocketed in 2020-21. Core inflation was held down by several categories that declined in June, led by a dip in prices for airfare (-8.1%), hotels & motels (-2.3%), and used vehicles (-0.5%). Meanwhile, a subset category of inflation that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, was unchanged in June, the lowest monthly reading in nearly two years. In the last twelve months, prices in the Super Core category are up 3.9%. The reason for the moderation in inflation this year is that the money supply stopped growing rapidly after surging in 2020-21. The M2 measure of money is down 4.0% versus a year ago. If this persists — and it remains to be seen whether it will — it would eventually bring inflation back down to the Fed’s 2.0% target. For now, the Fed has gained some traction in its fight against inflation, but the battle is not over.