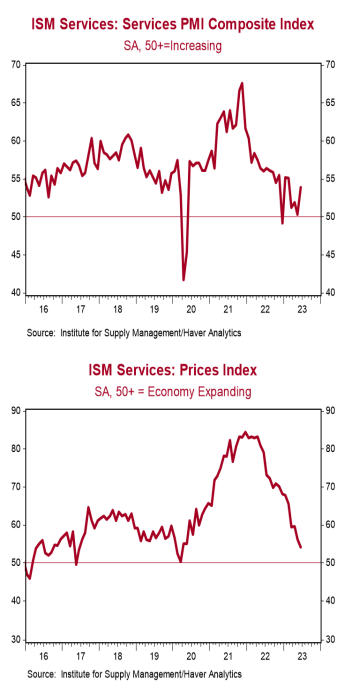

- The ISM Non-Manufacturing index increased to 53.9 in June, well above the consensus expected 51.2. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mostly higher in June. The business activity index jumped to 59.2 from 51.5, while the new orders index increased to 55.5 from 52.9. The employment index rose to 53.1 from 49.2, while the supplier deliveries index ticked down to 47.6 from 47.7.

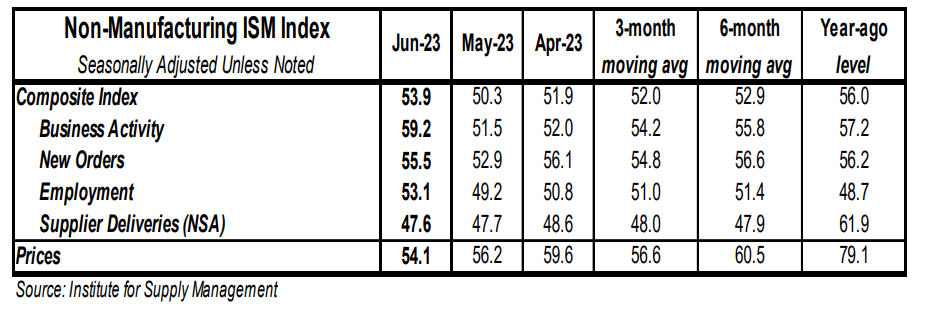

- The prices paid index declined to 54.1 in June from 56.2 in May.

Implications:

The two June ISM reports were a great display of the divergence in the US economy between the goods and services sectors. Earlier this week, we learned the ISM Manufacturing index continued to fall, missing consensus expectations, and remaining in contraction territory for the eighth month in a row. Meanwhile, the ISM Services index rose to 53.9 in June, with fifteen out of eighteen major industries reporting growth, and beating even the most optimistic forecast from any economics group. We continue to believe a recession is on the way, but it does not look like the services side of the economy is there just yet. Looking at the details, there were several things to like about today’s report. First, the business activity index jumped to 59.5 in June from 51.5 in May. Survey comments cited strong and stable business conditions as inflation rates begin to stabilize. Combine that with its forward-looking counterpart in the report – new orders – (which also rose in June) both indexes remain comfortably in expansion territory. Next, the employment index broke back into expansion territory, rising to 53.1 in June from 49.2 in May. Notably, some employers have reported that they are finally able to fill positions that have been open for some time. Finally, the prices index continued its downward trajectory, falling to 54.1 in June from 56.2 in May. The prices index has been trending downward since the 84.5 peak at the end of 2021 – but make no mistake – inflation still exists in the services sector and remains a problem for companies. Despite this month’s drop, twelve out of eighteen major industries reported paying higher prices in June, hence the index remains above 50, signaling inflation. We expect the service sector to keep inflation trending well above the Fed’s 2.0% target for some time. For now, the service sector remains a source of strength in the US economy. Expect it to continue to do most of the heavy lifting as we return back to the pre-pandemic status quo.