View from the Observation Deck

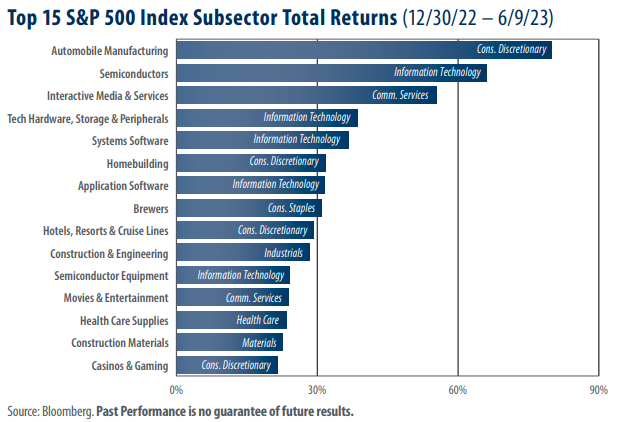

Today’s blog post is for those investors who want to drill down below the sector level to see what is performing

well in the stock market. The S&P 500 Index was comprised of 11 sectors and 126 subsectors as of 6/2/23,

according to S&P Dow Jones Indices. The 15 top-performing subsectors in the chart posted total returns ranging

from 21.53% (Casinos & Gaming) to 79.98% (Automobile Manufacturing). Click here to view our last post on the

top performing subsectors.

- As indicated in the chart above, 5 of the 15 top-performing subsectors, including the second-best

performing subsector year-to-date (Semiconductors), came from the S&P 500 Information Technology

sector. Consumer Discretionary had four subsectors represented, while Communication Services had two

subsectors represented. - With respect to the 11 major sectors that comprise the S&P 500 Index, Technology posted the highest total

return for the period captured in the chart, increasing by 35.54%, according to Bloomberg. The secondand third-best performers were Communication Services and Consumer Discretionary, with total returns

of 33.92% and 25.80%, respectively. The S&P 500 Index posted a total return of 12.81% for the period. - As of 6/2/23, the most heavily weighted sector in the S&P 500 Index was Information Technology at

27.88%, according to S&P Dow Jones Indices. For comparison, the Consumer Discretionary sector had a

weighting of 10.26%. - Of the 11 major sectors that comprise the S&P 500 Index, Energy had the lowest estimated year-end priceto-earnings ratio (9.88 as of 5/31), according to S&P Dow Jones Indices. Financials were a distant second at

12.41. Not including Real Estate, Information Technology has the highest 2023 estimated P/E ratio for the

sectors that comprise the S&P 500 Index, coming in at 28.68 as of 5/31.

Takeaway

The Information Technology sector accounts for 5 of the top 15 subsectors in today’s chart. Riding the wave of interest in artificial intelligence, technology stocks have been a clear outlier in 2023. Year-todate through 5/31, the S&P 500 Information Technology Index accounted for an astonishing 83.35% of the total return of the S&P 500 Index, according to S&P Dow Jones Indices. With representation in four subsectors, consumer discretionary stocks are a close second to their technology counterparts. That said, there is some concern that the U.S. consumer may weaken as the year progresses and federal incentives such as student loan forbearance and continued inflationary pressures take their toll. Thus far, the consumer has shrugged off these concerns. In April, real personal consumption expenditures (which are adjusted for inflation) increased by 0.5%.