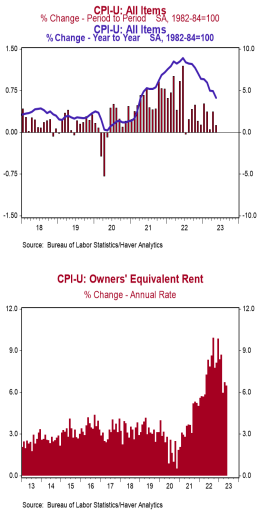

- The Consumer Price Index (CPI) rose 0.1% in May, matching consensus expectations. The CPI is up 4.0% from a year ago.

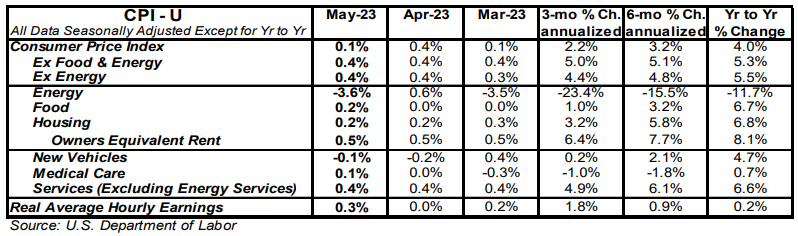

- Food prices rose 0.2% in May, while energy prices declined 3.6%. The “core” CPI, which excludes food and energy, rose 0.4% in May, matching consensus expectations. Core prices are up 5.3% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.3% in May and are up 0.2% in the past year. Real average weekly earnings are down 0.7% in the past year.

Implications:

Today’s CPI report showed progress in the battle against inflation, but the fight is not over. Headline inflation moderated in May, coming in-line with consensus expectations, while the year-over-year comparison dropped to 4.0% from 4.9% in April. Prices were once again held down by the volatile energy sector, which fell 3.6% in May. Stripping out energy and its often-volatile counterpart – food prices (+0.2% in May) – “core” prices rose 0.4%, also matching consensus expectations. The main driver within the core components was once again housing rents, which rose 0.5%. Even though rental inflation has been coming down from the back-breaking pace in the second half of 2022, rents for both actual tenants and the imputed rental value of owner-occupied homes are still running at or above a 6% annualized rate over three-, six-, and twelve-month timeframes. This is important because together they make up a third of the weighting in the overall index and have been major contributors to persistently high inflation over the last two years. We expect rents to continue to generate inflation as they catch up to home prices, which skyrocketed in 2020-21. Another notable mover within the core components was prices for used vehicles, which jumped 4.4% for the second month in a row after declining nine months straight before that. There were several categories that declined in May, led by prices for household furnishings and operations, which fell 0.6%. Notably, that is the first decline for that index in two years and the largest one-month decline since 2009. Meanwhile, a subset category of inflation that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, increased 0.2% in May after rising only 0.1% in April. In the last twelve months, prices in the Super Core category are up 4.6%, versus 4.0% in the overall index, and 5.3% in the “core” index. The reason for the moderation in inflation in the past year is that the money supply stopped growing rapidly after surging in 2020-21. Recently, the money supply has been falling. If this persists — and it remains to be seen whether it will — it would eventually bring inflation back down to the Fed’s 2.0% target. For now, monetary policy is tight and the Fed has gained some traction in its fight against inflation. However, do not get caught up in the relatively low year-over-year inflation readings for this month and likely next; that has more to do with “base effects,” as outsized monthly jumps in May and June 2022 roll off the year-ago comparisons. However, that surge in inflation last year was followed by a lull, with inflation barely budging in July and August 2022. That means we are very likely to see the twelve-month inflation readings re-accelerate toward the end of the summer.