View from the Observation Deck

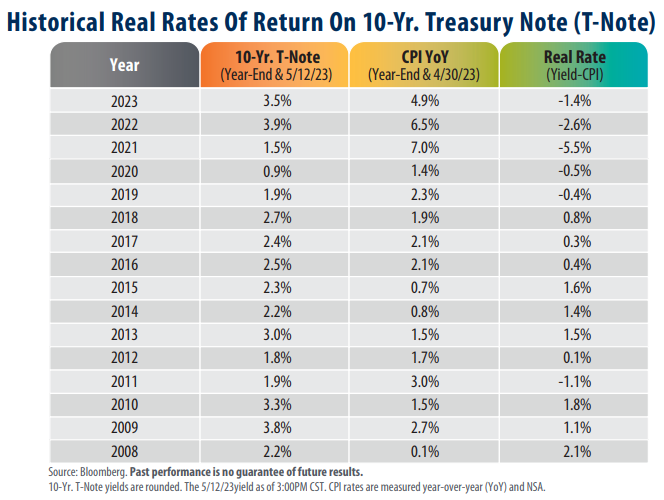

We like to update this table from time to time, to keep tabs on the impact the recent interest rate spikes may be having on the fixed income market. The real rate of return on a bond is calculated by subtracting the most recent inflation rate, such as the Consumer Price Index (CPI), from the bond’s current yield. The higher the real rate the better for investors. At a base level, in order to maintain one’s purchasing power, bond investors have sought to generate a yield that at least outpaces the rate of inflation over time.

The yield on the benchmark 10-year T-note was 3.47% (3.5% rounded) on 5/12/23, below the 4.9% trailing 12-month rate on the CPI in April 2023. That equates to a real rate of -1.4%, which obviously does not outpace inflation.

For comparative purposes, from 5/12/93 through 5/12/23 (30 years), the average yield on the 10-year T-note was 3.86% (3.9% rounded), while the average rate on the CPI stood at 2.5% (4/30/93-4/30/23), according to Bloomberg. Those figures translate into an average real rate of return of 1.4%, far more attractive than currently available real rates. For continued comparison, the S&P 500 Index experienced an average annual total return of 9.8% for the 30-year period ended 5/12/23.

As of 5/12/23, the federal funds target rate (upper bound) stood at 5.25%, up from 4.50% at the start of 2023, and significantly higher than when it stood at 0.25% at the start of 2022.

As the table shows, the CPI stood at 4.9% at the end of April 2023, significantly lower than its most recent peak of 9.1% in June 2022. A decrease in the growth rate of the CPI could be an indication that tighter monetary policy is having the desired effect on rising prices. That being said, the CPI remains well above its 30-year average rate of 2.5% (addressed above), and even further from the goal rate of 2.0% that the Federal Reserve (“Fed”) is aiming to achieve. A data point we find interesting is that the federal funds target rate (upper bound) averaged 2.48% for the 30-year period ended 4/28/23, almost exactly in-line with the 30-year average rate of inflation. The passage of time will reveal if the Fed realizes their goal rate of 2% inflation without having to increase the federal funds rate further.

Takeaway

Many pundits would argue that the recent slowdown in the rate of inflation, as measured by the CPI, is likely the result of the Fed’s shift towards tighter monetary policy. That same policy shift has ushered in a period of higher yields on the 10-year T-note (see table). Unfortunately for bond investors, higher interest rates have been unable to overcome the impact of inflation on real yields over the past several years. As today’s table reveals, the real yield on the 10-year T-note has been negative at the end of the last four consecutive years and remains negative today. While inflation is not the only metric the Fed looks to for guidance as it sets its target rate, it has openly stated that one of its goals is to reduce the CPI to 2.0% or lower. There were eight observations in today’s table where the CPI was 2.0% or lower. Real yields were positive in seven of those eight year-end snapshots.