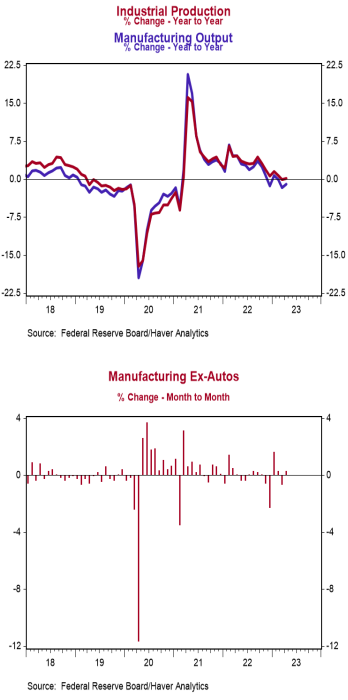

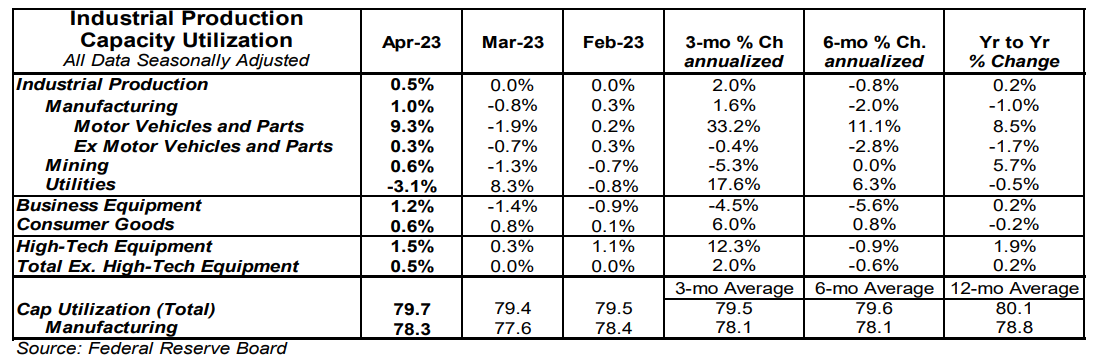

- Industrial production increased 0.5% in April (0.0% including revisions to prior months) versus a consensus expected 0.0%. Utilities output fell 3.1% in April, while mining rose 0.6%.

- Manufacturing, which excludes mining/utilities, increased 1.0% in April. Auto production jumped 9.3%, while non-auto manufacturing rose 0.3%. Auto production is up 8.5% in the past year, while non-auto manufacturing is down 1.7%.

- The production of high-tech equipment increased 1.5% in April and is up 1.9% versus a year ago.

- Overall capacity utilization rose to 79.7% in April from 79.4% in March. Manufacturing capacity utilization increased to 78.3% in April from 77.6%.

Implications:

Industrial production came in better than expected in April but was revised down in prior months, leaving the level of output in April right where the consensus expected. The biggest contributor to the gain in April itself was the manufacturing sector where activity rose 1.0%, with auto output soaring 9.3% and the rest of the manufacturing sector gaining 0.3%. Given the trend of consumers shifting their preferences back toward services and away from goods, we don’t expect as robust gains in manufacturing in future months. We are still forecasting a recession ahead with the goods sector leading the way. Meanwhile, the mining sector was another source of strength in April, posting an increase of 0.6%. The gain was driven by a faster pace of oil, gas, and other mineral extraction as well as more drilling of new wells. Given that the mining index remains below its pre-pandemic highs, we expect this series to continue to be a lifeline for industrial production in the near term. Finally, the one source of weakness in April came from utilities which are volatile and largely dependent on weather. The Federal Reserve points out that the 3.1% drop in April was due to a decrease in demand for heating as milder temperatures returned following an unseasonably cold March. In other recent factory news, the Empire State Index, a measure of New York factory sentiment, plunged unexpectedly to -31.8 in May from +10.8 in April, posting the largest monthly drop since the early days of the COVID pandemic. We also got data on the NAHB Housing Index this morning, a measure of homebuilder sentiment, which rose to 50 in May from 45 in April. This is the fifth consecutive gain and the first time the index has cracked 50 since July of 2022. An index reading of 50 signals that an equal number of builders view conditions as poor versus good and that sentiment is now neutral following nearly a year of pessimism.