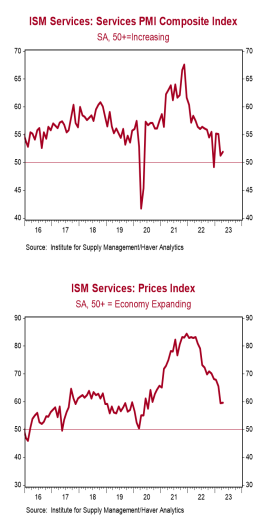

- The ISM Non-Manufacturing index increased to 51.9 in April, narrowly beating the consensus expected 51.8. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in April. The new orders index rose to 56.1 from 52.2, while the business activity index declined to 52.0 from 55.4. The employment index declined to 50.8 from 51.3, while the supplier deliveries index increased to 48.6 from 45.8.

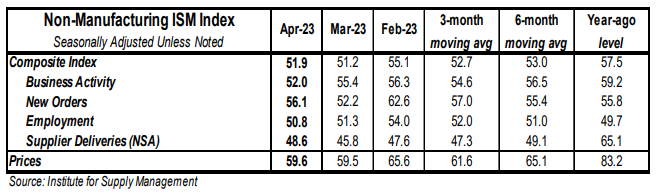

- The prices paid index ticked up to 59.6 in April from 59.5 in March.

Implications:

No sign of a recession in the services side of the US economy just yet. Today’s ISM Services report showed activity grew modestly in April, with the index rising to 51.9 from 51.2 in March and coming in a tick above the consensus expectation, with fourteen out of eighteen major industries reporting growth. The two forward-looking pieces of the report – new orders and business activity – were mixed in April, rising to 56.1 from 52.2 and falling to 52.0 from 55.4, respectively. However, both indexes stand in expansion territory, signaling growth. Contrasting this with the forward-looking pieces of the ISM Manufacturing report from Monday, it’s clear that businesses and consumers have been shifting away from goods and back toward services. While we don’t believe the services side of the economy is there yet, we continue to believe a recession is on the way in 2023, with the goods sector likely leading the way. Digging deeper into the details of today’s report showed mostly good news. On the employment front, activity grew for the third straight month, the longest streak of expansion since the beginning of 2022. Respondent comments confirm that businesses continue to hire to build up their staffing levels, despite recession uncertainties. Finally, the highest reading of any index in April came from prices paid, which ticked up to an elevated 59.6. As you can see from the chart nearby, the prices index has been trending downward since the 84.5 peak at the end of 2021 – but make no mistake – inflation is still a major problem in the service sector. Inflation woes continue to plague respondent comments and fifteen out of eighteen industries reported paying higher prices in April. The Federal Reserve’s job in wrestling inflation back down to its 2.0% target is clearly not over; we expect them to keep monetary policy tighter than what the market expects in the months to come. In other news this morning, ADP’s measure of private payrolls increased 296,000 in April versus a consensus expected 150,000. Plugging this into our models finalizes our forecast for the official nonfarm payroll report (to be announced Friday morning) at 190,000. In other recent news, automakers sold cars and light trucks at a 15.9 million annual rate in April, up 7.2% from March and up 11.4% from a year ago. In addition, sales of medium and heavy trucks hit a 563,000 annual rate in April, the fastest pace since 2019.