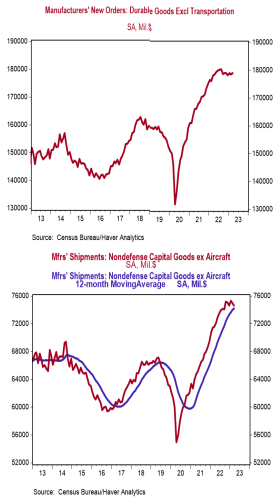

- New orders for durable goods rose 3.2% in March (+3.0% including revisions to prior months), easily beating the consensus expected +0.7%. Orders excluding transportation rose 0.3% in March (+0.1% including revisions), beating the consensus expected -0.2%. Orders are up 4.6% from a year ago, while orders excluding transportation are up 0.5%.

- A surge in orders for commercial aircraft in March led gains across nearly all major categories.

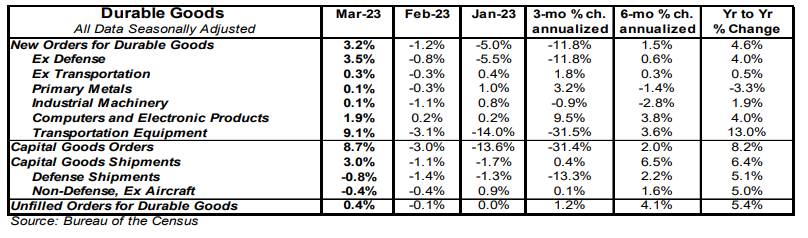

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure declined 0.4% in March, but was up at a 0.1% annualized rate in Q1 versus the Q4 average.

- Unfilled orders rose 0.4% in March and are up 5.4% in the past year.

Implications:

New orders for durable goods surged 3.2% in March, easily beating consensus expectations. However, when you look past the headline, there isn’t much to like in the March report. The surge in orders was due to the volatile commercial aircraft category, which after plummeting a combined 60% in the first two months of 2023, rebounded 78.4% in March. Stripping out transportation, orders rose a tame 0.3% while prior month activity was revised lower. Meanwhile, core shipments – a key input for business investment in the calculation of GDP – declined 0.4% in March and were up at a meager 0.1% annualized rate in the first quarter versus the Q4 average. In the past year, orders for durable goods are up 4.6%, while orders excluding transportation are up 0.5%. While those numbers would be okay in the low inflation environment that followed the Great Recession, producer prices for capital equipment are up 6.8% in the past year, which means that while orders are still rising in dollar terms, they are declining when adjusted for inflation. A number of factors are likely to generate turbulent footing in 2023: a tighter Federal Reserve, the tightening of lending standards following recent stress in the banking sector, and withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending. In addition, the return toward services means a large portion of goods-related activity will soften in the year ahead, even as some durables that facilitate services recover. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft declined 0.4% in March while the previous month was revised lower. Despite the surge in January, which likely benefited from seasonal adjustment factors that took growth away from the final months of 2022, this measure barely managed to eke out a gain in the first quarter of 2023. While we are forecasting the economy grew at a 2.2% annual rate in the first quarter, don’t expect Real GDP to remain positive much longer. We think the second quarter will likely be weaker than Q1, and possibly negative. As for other economy-wide news, the Federal Reserve reported on Tuesday that the M2 measure of the money supply dropped 1.2% in March, is down 4.1% from a year ago, and is down at a 6.1% annualized rate from the peak in July. Not only have we never experienced a Fed trying to fight an inflation problem under an abundant reserve regime, we’ve never seen M2 grow so fast for so long, or decline so rapidly, at least since the Great Depression. If the recent data are accurate, this is not a good sign for Real GDP growth in the year ahead and consistent with our view that we’re headed for a recession.