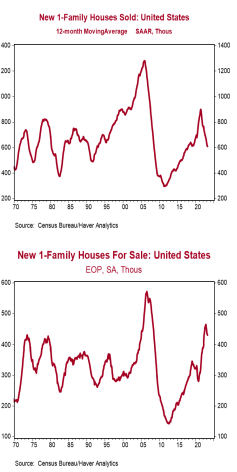

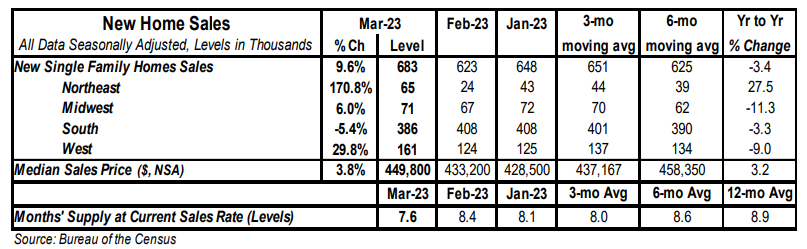

- New single-family home sales increased 9.6% in March to a 0.683 million annual rate, easily beating the consensus expected 0.632 million. Sales are down 3.4% from a year ago.

- Sales in March rose in the Northeast, Midwest and West, but fell in the South.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) ticked down to 7.6 in March from 8.4 in February. The decline was due to both a faster pace of sales and a 2,000 unit drop in inventories.

- The median price of new homes sold was $449,800 in March, up 3.2% from a year ago. The average price of new homes sold was $562,400, up 9.9% versus last year.

Implications:

New home sales continued to recover in March, signaling that activity may have hit at least a temporary bottom back in mid-2022. While sales are on an upward trend recently and are now up 25.8% from the low in July of last year, they still remain well below the pandemic highs of 2020. The main issue with the US housing market has been declining affordability, with potential buyers getting squeezed by both higher prices and rapidly rising mortgage rates. Assuming a 20% down payment, the change in mortgage rates and home prices in just the past year amounts to a 27% increase in monthly payments on a new 30-year mortgage for the median new home. No wonder sales have slowed down! With 30-year mortgage rates currently sitting near 7.0%, financing costs remain a headwind. On top of this, given the recent instability in the banking system there is likely more volatility ahead for the housing market as lending standards are tightened further. A piece of good news is that while a lack of inventory has contributed to price gains in the past couple of years, in general, inventories have made substantial gains recently. The months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now 7.6, up significantly from 3.3 early in the pandemic. Most importantly, the supply of completed single-family homes has more than doubled versus a year ago. This is in contrast to the market for existing homes which continues to struggle with an inventory problem often due to the difficulty of convincing current homeowners to give up the low fixed-rate mortgages they locked-in during the pandemic. Though not a recipe for a significant rebound, more inventories should help moderate new home prices and put a floor under sales activity. One problem with assessing housing activity is that the Federal Reserve held interest rates artificially low for more than a decade. With rates now in a more normal range, the sticker shock on mortgage rates for potential buyers is very real. However, we have had strong housing markets with rates at current levels in the past, and homebuyers will eventually adjust, possibly by looking at lower priced homes. Speaking of home prices, they were up in February. The national Case-Shiller index rose 0.2% while the FHFA index increased 0.5%. However, both indexes are still down from the peak last June, the Case-Shiller index by 2.8% and the FHFA index by 0.1%. On the manufacturing front, the Richmond Fed index, a measure of mid-Atlantic factory activity, fell to -10.0 in April from -5 in March, still signaling contraction.