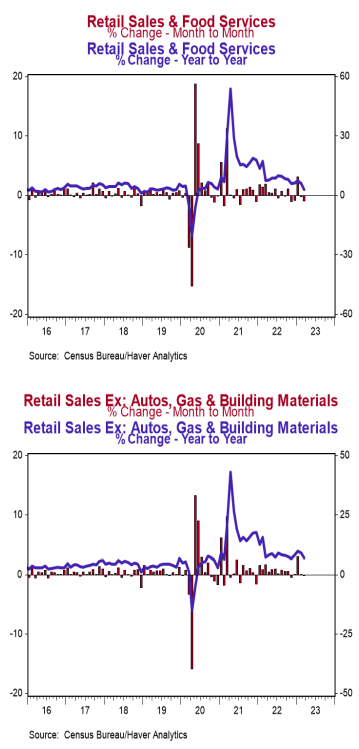

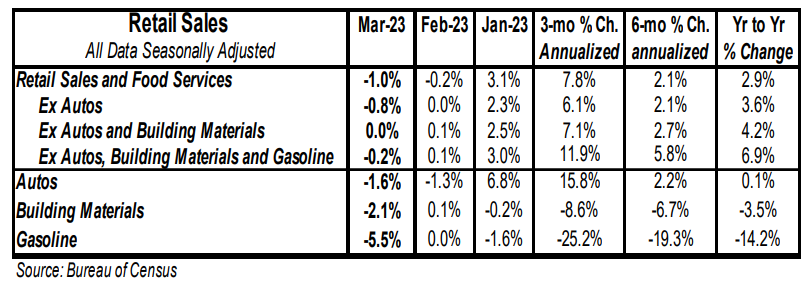

- Retail sales declined 1.0% in March (-0.9% including revisions to prior months), lagging the consensus expected decline of 0.5%. Retail sales are up 2.9% versus a year ago.

- Sales excluding autos dropped 0.8% in March, below the consensus expected 0.4% decline. These sales are up 3.6% in the past year.

- The largest declines in March were for gas stations, general merchandise stores, and autos. The largest increase was for non-store retailers (internet & mail-order).

- Sales excluding autos, building materials, and gas declined 0.2% in March. These sales were up at a 11.4% annual rate in Q1 versus the Q4 average.

Implications:

Retail sales continued to cool in March, falling 1.0%, after an abnormally strong print in January that had more to do with one-off factors (seasonal adjustments and unusually warm weather) rather than economic fundamentals. The weakness in retail sales in March itself was fairly widespread as eight of thirteen retail categories declined, led by gas stations, general merchandise stores (think department stores), and autos. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas stations, and is an important measure for estimating GDP, declined 0.2% in March. In the last twelve months, retail sales are up only 2.9%, the slowest yearly gain since June of 2020. In spite of weaker sales in the past two months, the personal consumption portion of Real GDP should come in strong for Q1, due to the surge in sales in January as well as continued improvement in service spending as part of the recovery from COVID lockdowns. However, we expect the strong gain in personal consumption in the first quarter to be a one-off event. Consumers continue to face a headwind from inflation, which is fully offsetting gains in hourly pay. Meanwhile, the very loose monetary policy of 2020-21 has translated into higher inflation, which is why “real” (inflation-adjusted) retail sales are down versus a year ago. Our view remains that the tightening in monetary policy since last year will eventually deliver a recession. In other news this morning, import prices fell 0.6% in March while export prices declined 0.3%. In the past year, import prices are down 4.6%, while export prices are down 4.8%. Both these pieces of data demonstrate weakness in the goods sector of the economy, which we believe will lead the way into a recession.