View from the Observation Deck

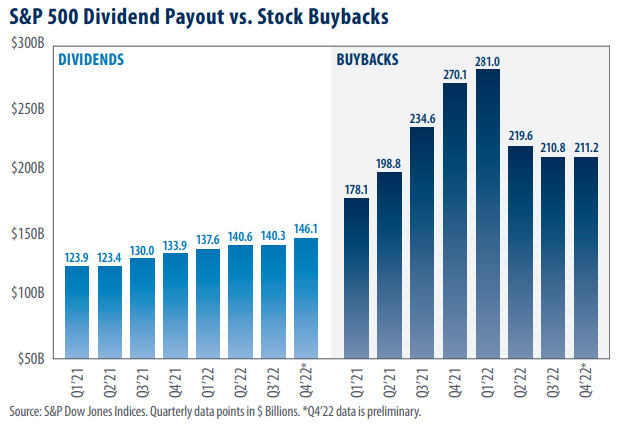

Companies have a number of ways in which to return capital to their shareholders. As the chart above shows, cash dividends and stock buybacks have been two of the more popular methods that corporations have utilized in recent years. Dividend distributions steadily increased over the period, while share buybacks receded after peaking in Q1’22. Even so, buybacks remain a significant source of overall capital disbursements. Total shareholders return of dividends and buybacks totaled $1.487 trillion during the 2022 calendar year, up from $1.393 trillion in 2021.

• The all-time high for the S&P 500 Index’s quarterly dividend payout was the $146.1 billion distributed in Q4’22,

according to data from S&P Dow Jones Indices.

• As the chart shows, dividend distributions increased on a quarterly basis for three of the four quarters in 2022.

In fact, the companies that comprise the S&P 500 Index distributed a record $564.6 billion in dividends in 2022.

• Quarterly stock buybacks totaled $211.2 billion in Q4’22, down from a record high of $281.0 in Q1’22, according

to data from S&P Dow Jones Indices.

• Despite the downward trend revealed in the chart, annual share repurchases stood at a record $922.7 billion for

the 2022 calendar year.

• As of Q4’22, the S&P 500 Index sectors that were most aggressive in repurchasing their stock were as follows (% of

all stocks repurchased): Information Technology (27.3%); Health Care (11.6%); and Financials (10.7%), according

to S&P Dow Jones Indices.

Takeaway

Despite the record-setting levels of both dividend distributions and share repurchases, the companies in

the S&P 500 Index are sitting on a mountain of cash. Corporate cash holdings, as measured by the S&P

500 Industrials (Old) Cash & Equivalents (excluding Financials, Utilities and Transportation companies),

totaled $1.58 trillion (preliminary) on 12/30/22. While the chart clearly shows that stock buybacks are

receding from the high set in Q1’22, they are not alarmingly low, and the record-setting pace with which

companies repurchased shares throughout 2022 could be an indicator of overall strength, in our opinion.

As indicated in the chart, dividend distributions have remained relatively consistent. In our view, this is

to be expected. Generally, companies tend to avoid cutting their dividend, as the action can be viewed

as an indication of financial weakness. The 1% tax on stock buybacks that went into effect this year does

not appear to have quelled demand. Companies announced a record $132 billion of share repurchases in

January, nearly 15% higher than the previous record for the month.