View from the Observation Deck

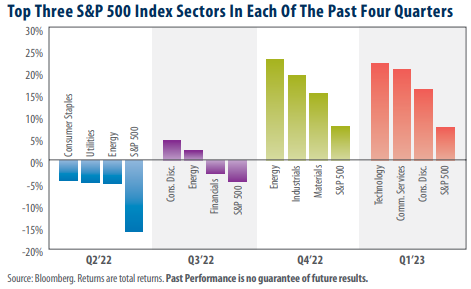

One of the most common questions we field on an ongoing basis is the following: What are your favorite sectors? Today’s blog post is one that we update on a quarterly basis to lend context to our responses. Sometimes the answer is more evident than at other times, and sometimes it only makes sense via hindsight, such as Technology’s outperformance in the current climate, in our opinion. While the above chart does not contain yearly data, since 2005, only two sectors in the S&P 500 Index have been the top-performer in back-to-back calendar years. Information Technology was the first, posting the highest total return in 2019 (+50.29%) and 2020 (43.89%). Energy was the second, posting the highest total return in 2021 (54.39%) and 2022 (65.43%), according to Bloomberg.

1. The top-performing sectors in Q1’23 were as follows (total returns): 21.82% (Technology), 20.50% (Communication Services) and 16.05% (Consumer Discretionary). The total return on the S&P 500 Index was 7.48%. The other eight sectors generated total returns ranging from 4.29% (Materials) to -5.56% (Financials).

2. For comparative purposes, the top-performing sectors in Q1’22 were as follows (total returns): 39.03% (Energy), 4.77%% (Utilities) and -1.01% (Consumer Staples). The worst-performing sectors for the period (total return) were: -11.92% (Communication Services), -9.03% (Consumer Discretionary) and -8.36% (Information Technology).

3. The S&P 500 posted a total return of -18.13% for the 2022 calendar year. Of the 11 major sectors that comprise the index, only Energy and Utilities registered positive total returns in 2022.

4. Click here to access the post featuring the top-performing sectors in Q2’21, Q3’21, Q4’21 and Q1’22

Takeaway

As we can observe from today’s chart, the top-performing sectors can vary wildly from quarter to quarter. In our view, lower interest rates across much of the yield curve likely provided a significant boost to the valuations of the top-performing sectors over the first quarter. In addition, an easing in the chips shortage and relatively strong consumer spending data in January and February may have fostered growth in the Technology and Consumer Discretionary sectors at the start of 2023. That said, it is possible that the advantage those sectors enjoyed could dissipate in the coming months, in our opinion. In a sign of potential weakness to come, a total of 554 technology companies announced layoffs of over 167,000 employees year-to-date through 4/4/23. Furthermore, consumer sentiment, as measured by the University of Michigan’s Consumer Sentiment Index, fell from a reading of 67 in February, to 62 in March, although the metric is still higher than where it stood in March of last year. Should consumer spending falter, we would expect to see the Consumer Discretionary sector follow suit. We look forward to seeing what the data reveals next quarter.