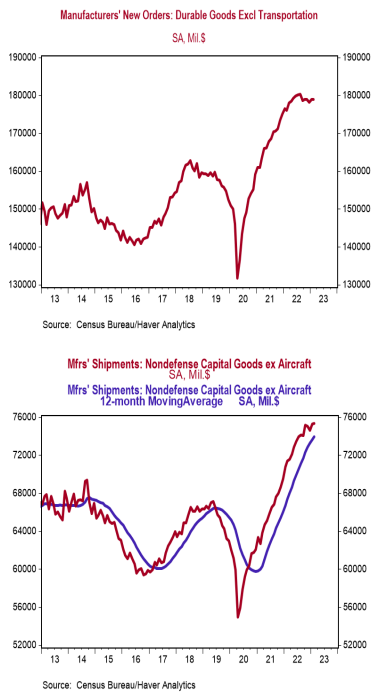

- New orders for durable goods declined 1.0% in February (-1.5% including revisions to prior months), lagging the consensus expectation of no change. Orders excluding transportation were unchanged in February (-0.3% including revisions), lagging the consensus expected +0.2%. Orders are up 2.2% from a year ago, while orders excluding transportation are up 1.7%.

- Orders fell across virtually every category, with commercial aircraft, defense aircraft, and autos leading orders lower.

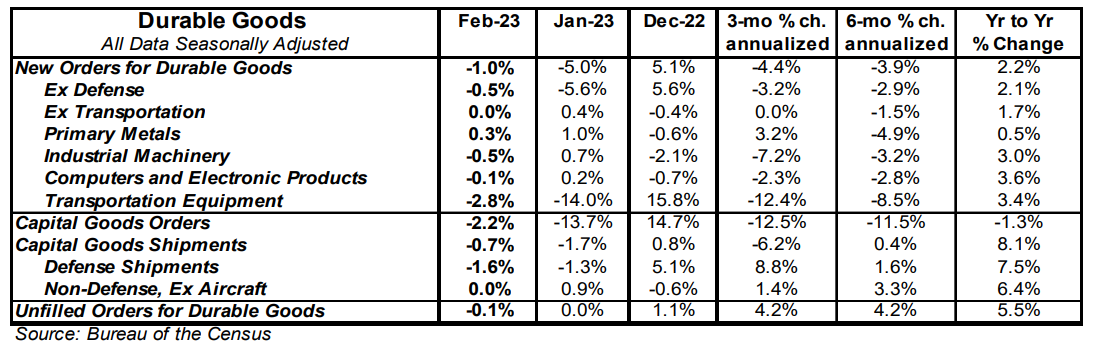

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure was unchanged in February. If also unchanged in March, these orders would be up at a 2.0% annualized rate in Q1 versus the Q4 average.

- Unfilled orders declined 0.1% in February but are up 5.5% in the past year.

Implications:

There isn’t much to like in the February report on durable goods, where orders declined across nearly every major category, prior month activity was revised lower, and core shipments – a key input for business investment in the calculation of GDP – were unchanged. Overall, new orders for durables fell 1.0% in February, led by declines in the transportation sector. Take out the typically volatile transportation sector and orders were unchanged in February, as a rise in orders for primary metals and fabricated metal products offset declines across most other categories. In the past year, orders for durable goods remain up 2.2%, while orders excluding transportation are up 1.7%. While those numbers would be okay in the low inflation environment that followed the Great Recession, producer prices for capital equipment are up 7.1% in the past year, which means that while orders are still rising in dollar terms, they are declining when adjusted for inflation. A number of factors are likely to generate turbulent footing in 2023, including elevated interest rates, a Fed still hiking, the likely tightening of lending standards following recent turbulence in the banking sector, and withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft were unchanged in February following a 0.9% rise in January which likely benefited from seasonal adjustment factors that took growth away from the final months of 2022. If unchanged in March, these shipments would be up at a 2.0% annualized rate in Q1 versus the Q4 average, which provides a (temporary) tailwind for first quarter GDP. The shift from services to goods accelerated overall durable goods purchases beyond where they would have been had COVID never happened. The return toward services means a large portion of goods-related activity will soften in the year ahead, even as some durables that facilitate services recover. In other recent news on the manufacturing front, the Kansas City Fed index, a measure of manufacturing activity in that region, remained unchanged at 0 in February. We expect soft readings from the manufacturing sector to be an ongoing theme in 2023.