View from the Observation Deck

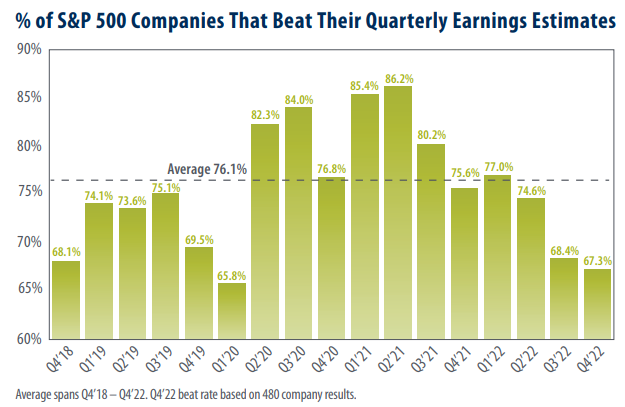

As we head into the close of the Q4’22 corporate earnings reporting season, we thought it would be a good time to review the percentage of S&P 500 Index companies that exceed their quarterly earnings estimates. Equity analysts adjust their corporate earnings estimates on an ongoing basis. Regardless of whether they adjust their estimates up or down, companies typically have a consensus target number or range to hit.

• From Q4’18 through Q4’22 (17 quarters), the average earnings beat rate for the companies that comprise the index was 76.1%, notably higher than the 67.3% beat rate for the 480 companies that have reported results for Q4’22.

• As indicated in the chart, only one of the last six quarterly beat rates (Q3’21) exceeded the 80% mark. • At 67.3%, the earnings beat rate for Q4’22 is the lowest the rate has been since Q1’20 (the start of the COVID-19 pandemic).

• The S&P 500 Index posted a cumulative total return of 41.80% for the period covered by the chart (9/28/18–12/30/22), according to Bloomberg.

• Information Technology (78.87%), Consumer Discretionary (77.55%) and Health Care (75.41%) have registered the highest earnings beat rates in Q4’22 (not in chart), according to S&P Dow Jones Indices. Communication Services had the lowest beat rate at 47.83%.

Takeaway

Refinitiv reported that when it comes to positive surprises, earnings have been a mere 1.6% above estimates in Q4’22, according to CNBC. The figure is the lowest that it has been in 15 years. Furthermore, earnings quality appears to be weakening. Bloomberg reported that for every dollar of profits, $0.88 was matched by cash inflows, the biggest discrepancy since at least 1990. On a dollar basis, Bloomberg’s 2022, 2023 and 2024 consensus earnings per share estimates for the S&P 500 Index stood at $222.4, $220.5 and $245.4, respectively, as of 3/3/23.