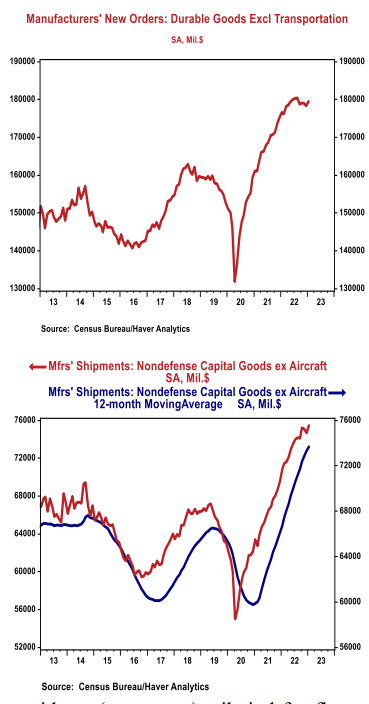

- New orders for durable goods declined 4.5% in January (-5.0% including revisions to prior months), coming in below the consensus expected -4.0%. Orders excluding transportation rose 0.7% in January (+0.5% including revisions), beating the consensus expected +0.1%. Orders are up 3.0% from a year ago, while orders excluding transportation are up 1.6%.

- A decline in orders for commercial aircraft in January was only partially offset by rising orders for machinery, defense aircraft, and computers & electronic products.

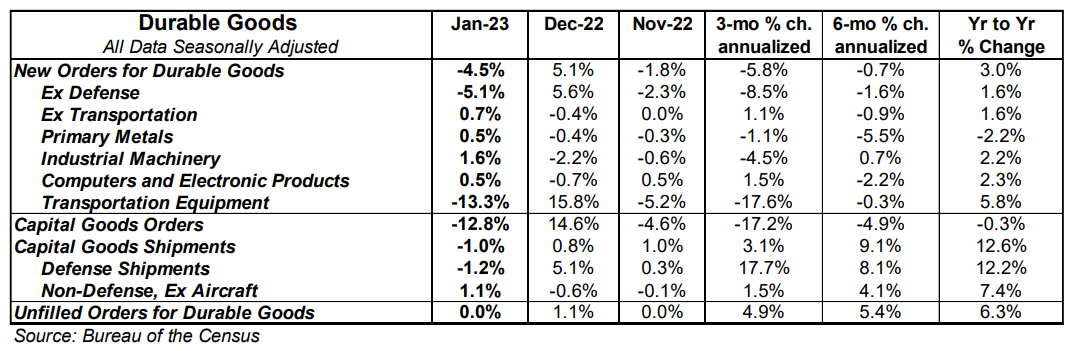

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure rose 1.1% in January. If unchanged in February and March, these orders would be up at a 2.6% annualized rate in Q1 versus the Q4 average.

- Unfilled orders were unchanged in January but are up 6.3% in the past year.

Implications:

A mixed report for durable goods for January. Overall, new orders for durables fell 4.5% for the month. However, declines were concentrated among very volatile orders for commercial aircraft; strip out that single category and orders rose 0.8% in January, likely aided by unusually warm weather and a rebound from weaker activity around the 2022 holiday season. Take out the broader transportation sector - which also includes defense aircraft and autos - and orders rose 0.7% in January and are up 1.6% from a year ago. That seems like good news until you remember that producer prices for capital equipment are up 7.7% during the same time period, which means that while orders are still rising in dollar terms, they are declining when adjusted for inflation. Elevated interest rates, a Fed still hiking, and the fading of COVID era stimulus that boosted both consumer and business spending are likely to provide turbulent footing throughout much of 2023. Diving into the core non-transportation categories, orders in January were led by machinery (+1.6%), computers and electronic products (+0.5%), and primary metals (+0.5%). One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), rose 1.1% in January following declines in the last two months of 2022. If unchanged in February and March, these shipments would be up at a 2.6% annualized rate in Q1 versus the Q4 average, which provides a (temporary) tailwind for first quarter GDP. The shift from services to goods accelerated overall durable goods purchases beyond where they would have been had COVID never happened. The return toward services means a large portion of goods-related activity will soften in the year ahead, even as some durables that facilitate services recover.