View from the Observation Deck

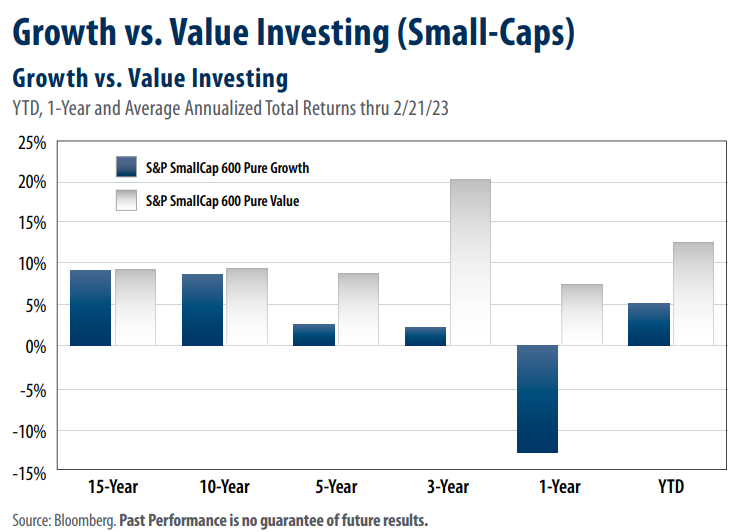

We update this post on small-capitalization (cap) stocks every now and then so that investors can see which of the two styles (growth or value) are delivering better results.

The S&P SmallCap 600 Pure Value Index outperformed its growth counterpart in each of the six periods featured in

today’s chart.

As of January 31, 2023, the S&P SmallCap 600 Pure Value Index’s largest sector was Consumer Discretionary at 28.9%,

while the S&P SmallCap 600 Growth Index’s largest sector was Health Care at 20.07%.

Year-to-date thru February 21, 2023, the S&P SmallCap 600 Consumer Discretionary Index and the S&P SmallCap 600 Health Care Index posted total returns of 15.46% and 4.49%, respectively. For comparative purposes, the S&P SmallCap 600 Index was up 7.66% on a total return basis over the same period. The S&P 600 SmallCap Pure Value Index had a 4.9% weighting in the Health Care sector (the Growth Index’s largest sector) and the S&P 600 Pure Growth Index had just a 7.5% weighting in the Consumer Discretionary sector (the Value Index’s largest sector) as of January 31, 2023.

The total returns in today’s chart, thru February 21, 2023 were as follows (Pure Growth vs. Pure Value):

![]()

The last time that we wrote about this topic was on May 26, 2022. Click Here to view that post.

In it, we wrote: “at a combined weighting of 22.2%, the S&P SmallCap 600 Pure Value Index’s exposure to Energy and Materials was significantly higher than the 5.0% combined weighting in the S&P SmallCap 600 Pure Growth Index as of 4/29/22”. Over the 1-year period ended February 21, 2023, the S&P SmallCap 600 Energy Index and the S&P SmallCap 600 Materials Index were the first and fifth-best performers, posting total returns of 24.59% and 5.20%, respectively.