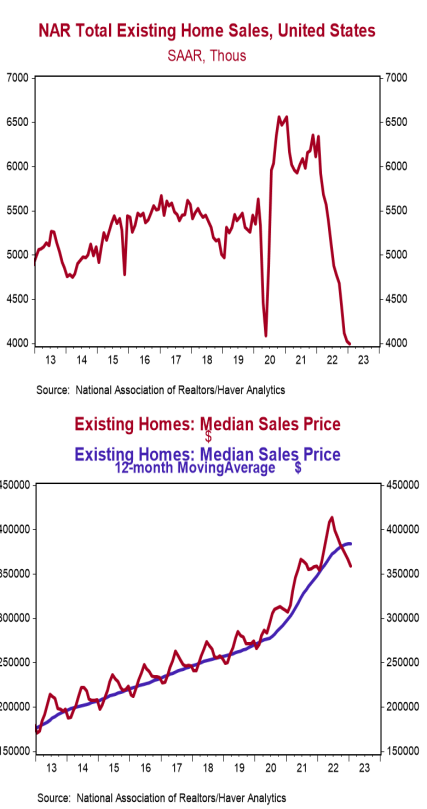

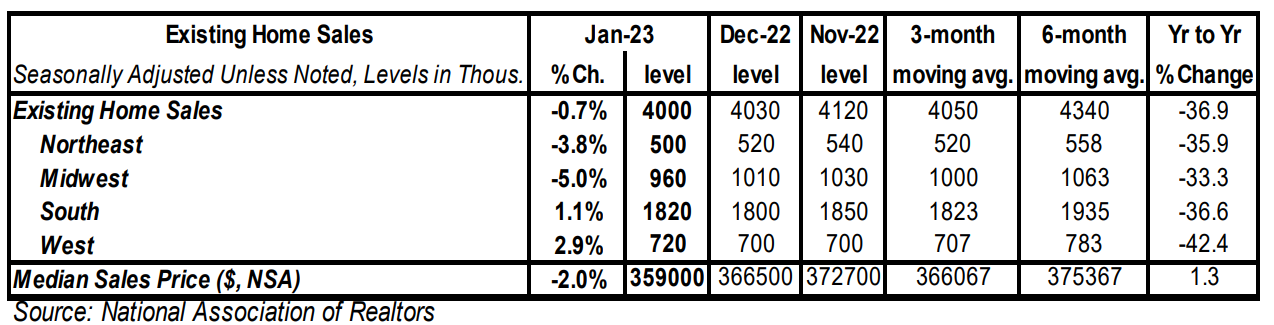

- Existing home sales declined 0.7% in January to a 4.000 million annual rate, lagging the consensus expected 4.100 million. Sales are down 36.9% versus a year ago.

- Sales fell in the Midwest and Northeast but rose in the West and South. The drop was entirely due to a decline in sales of single-family homes. Sales of condos/co-ops remained unchanged in January.

- The median price of an existing home fell to $359,000 in January (not seasonally adjusted) but is up 1.3% versus a year ago.

Implications:

Existing home sales started off 2023 by falling for a twelfth consecutive month, hitting the lowest level in more than a decade. Falling affordability has played a major role in the record streak of declining reports. The prime culprit is the surge in mortgage rates, with interest rates on 30-yr fixed rate loans currently hovering near 6.8%. Moreover, those rates have been on the rise again recently, signaling there are likely still choppy waters ahead for the housing market. When you do the math it’s not hard to see why home sales have slowed down so rapidly. Assuming a 20% down payment, the rise in mortgage rates and home prices since January 2022 amounts to a 36% increase in monthly payments on a new 30-year mortgage for the median existing home. While financing costs remain a burden, the good news for prospective buyers is that median prices fell for the seventh month in a row in January. Part of this is just seasonality, and even with recent declines median prices are still up 1.3% versus a year ago. But we expect year-ago price comparisons to go negative in the next few months. Today’s report also showed that the inventory of existing homes on the market remains tight. One piece of good news in today’s report was that available listings rose for the first time in six months and are up 15.3% from a year ago (the best way to look at the data given the seasonality of the housing market). However, these inventories are still low by historical standards, and we think low inventories will remain a problem given that many homeowners locked in mortgage rates at rock bottom levels during the pandemic, and potential sellers are unlikely to brave a 300+ basis point increase in financing costs by re-entering the market to trade up. For example, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) fell to 2.9 in January, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. Despite the lack of options, homes that are put on the market are still selling quickly: 54% of existing homes sold were on the market for less than a month. While sales are clearly under pressure, this is not a repeat of the 2006-11 housing bust. Unlike the previous housing bust, we do not have a massive oversupply of homes. Meanwhile, a flood of new inventories hitting the market due to foreclosure remains unlikely. Adjustable-rate mortgages make up a much smaller share of overall mortgages today than in the lead up to the prior housing crisis. Many current homeowners have locked-in fixed long-term mortgages at extremely low interest rates, which would make them very reluctant to default on their mortgage even if the economy turns for the worse. Expect sales and prices to drag on in the year ahead, with no real recovery in housing until at least late 2023 or early 2024.