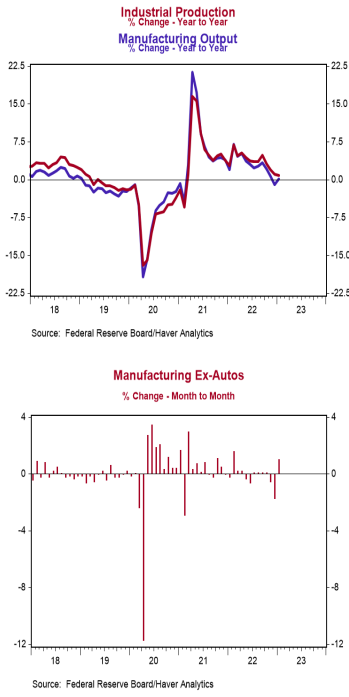

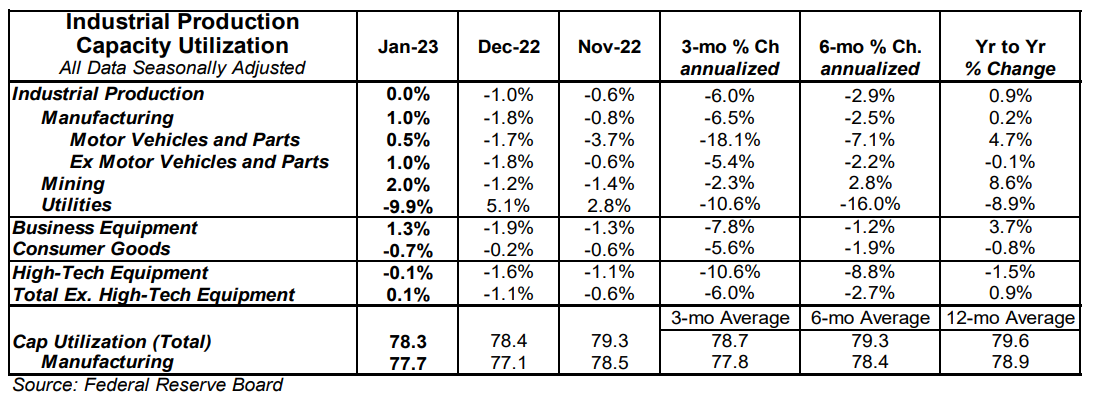

- Industrial production was unchanged in January (-0.4% including revisions to prior months), well below the consensus expected gain of 0.5%. Utilities output fell 9.9% in January, while mining rose 2.0%.

- Manufacturing, which excludes mining/utilities, increased 1.0% in January (+0.4% including revisions to prior months). Auto production rose 0.5%, while non-auto manufacturing increased 1.0%. Auto production is up 4.7% in the past year, while non-auto manufacturing is down 0.1%.

- The production of high-tech equipment declined 0.1% in January and is down 1.5% versus a year ago.

- Overall capacity utilization ticked down to 78.3% in January from 78.4% in December. Manufacturing capacity utilization rose to 77.7% in January from 77.1%.

Implications:

Industrial production continued to disappoint in January, remaining unchanged for the month and coming in below consensus expectations. Moreover, data from previous months were revised lower, as well. Industrial production is now down 6.0% at an annualized rate in the past three months, nearly matching December’s three-month reading which was the worst since the early days of COVID and another signal that a recession is likely on the way in 2023. Although the overall report was not good, it is important to point out that the details in today’s report were better than the headline number. All the weakness in January came from the utilities sector (which is largely dependent on weather), where activity posted a decline of 9.9%, the largest monthly decline in series history going back to 1939, and the result of unseasonably warm weather in January following unseasonably cold weather in December. Meanwhile, all other major categories posted gains in January, also probably related to the better weather, which meant less lost time for production. The manufacturing sector was the biggest positive contributor in January, posting a gain of 1.0%. Looking at the details, both auto and non-auto manufacturing rose in January, posting gains of 0.5% and 1.0%, respectively. However, given the recent trend of American consumers shifting their preferences back toward services and away from goods, we don’t expect this strength to last. Another source of strength was mining, which posted a gain of 2.0% in January. A faster pace of oil, gas, and other mineral extraction more than offset a decline in the drilling of new wells. It looks like oil prices, which are currently still hovering near $80 a barrel, continue to incentivize new production. We continue to expect the US energy sector to be a lifeline for industrial production in 2023. In other recent manufacturing news, the Empire State Index, a measure of New York factory sentiment, rose to a still weak reading of -5.8 in February from -32.9 in January.