View from the Observation Deck

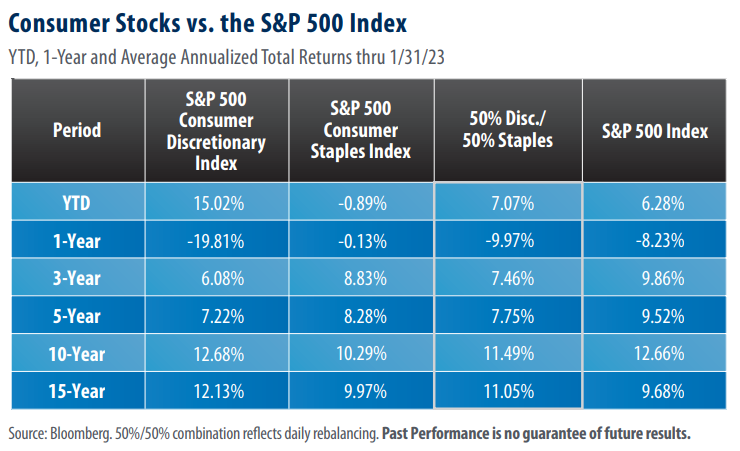

Today’s post compares the performance of consumer stocks to the broader market, as measured by the S&P 500 Index, over an extended period. The table above is constructed of the total returns of the S&P 500 Consumer Discretionary, S&P 500 Consumer Staples and S&P 500 Indices, respectively, during the noted time frames. It also includes a 50/50 blend of the S&P 500 Consumer Discretionary and S&P 500 Consumer Staples Indices to provide a proxy for consumer stocks as a whole.

The YTD returns in the S&P 500 Consumer Discretionary Index may indicate that investors believe inflation, as measured by the Consumer Price Index (CPI) is expected to ease.

As consumers tightened their belts amidst the one-two combo of COVID-induced lockdowns and surging inflation, consumer discretionary stocks suffered, underperforming the S&P 500 Index over the 1, 3 and 5-year periods in today’s table. In January, however, the S&P 500 Consumer Discretionary Index posted a total return that was more than double that of the S&P 500 Index. Right on cue, preliminary results of The University of Michigan’s U.S. consumer sentiment survey were released on February 9, revealing that consumer sentiment rose to its highest level in 13 months in January. In our view, the increase in sentiment is predicated on the belief that the Federal Reserve (“Fed”) may be winning their battle with stubbornly high inflation. If this is the case, consumers may expect that recent pressures from rising interest rates could begin to subside.

There is a lot riding on the U.S. Consumer. As many investors know, the consumer plays a significant role in the health of the U.S. economy. Over the 15-year time period ended on October 1, 2022, consumer spending accounted for 67.8% of GDP on average. Crucially, recent data regarding consumer health has been mixed, in our opinion. The Commerce Department reported that in December, the U.S. savings rate rose to 3.4%, its highest level in seven months. December’s number was a welcome reversal from a series of declines over the 2021 and 2022 calendar years, but could also indicate that consumers are beginning to pull back on discretionary spending amidst a cloudier economic outlook, according to Bloomberg. Recent data shows that the average interest rate on U.S. credit cards rose to 19.07% in the fourth quarter of 2022, its highest level in over 50 years. Additionally, U.S. credit card debt reached a record $930.6 billion in the fourth quarter, jumping 18.5% year-over-year. Even so, debt service payments accounted for just 9.75% of disposable personal income in the third quarter of 2022, up from their historic low of 8.33% in 2021, but well below the peak of 13.17% in 2007.

Takeaway

One explanation for January’s stunning reversal in the total return of the S&P 500 Consumer Discretionary Index is the possibility that inflation has continued to moderate. Falling inflation would be a welcome relief to many Americans who, stretched thin by rising interest rates, plummeting savings and record levels of credit card debt, are a significant driver of economic growth. Tellingly, over the 15-year period ended October 1, 2022, consumer spending accounted for 67.8% of U.S. GDP, on average. Should the consumer remain healthy, the possibility of the U.S. experiencing a notable recession could be diminished. Alternatively, discretionary spending is likely to continue to decline if we are heading towards a recession. Stay tuned!