View from the Observation Deck

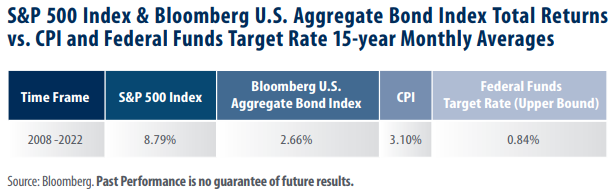

For today’s blog post, we thought it would be helpful to compare the performance of the broader U.S. bond market with changes in the Consumer Price Index (CPI) and the federal funds target rate over time. The table above shows the average monthly total returns for the S&P 500 Index and the Bloomberg U.S. Aggregate Bond Index and compares them to the average increase in the trailing 12-month rate of the Consumer Price Index (CPI) over a 15-year time frame. We also included the monthly average for the federal funds target rate (upper bound) over the period.

The total return of the Bloomberg U.S. Aggregate Bond Index has not kept pace with the rate of inflation as measured by the Consumer Price Index (CPI).

As can be seen in the table, the average annual monthly increase in the CPI rate for the 15-year period ended December 2022 was 3.10%. The total return for the Bloomberg U.S. Aggregate Bond Index was a meager 2.66% by comparison over the same time period. The surge in the CPI rate over the 2021 and 2022 calendar years is partially to blame for the bond market’s inability to keep pace with inflation, but doesn’t tell the whole story, in our opinion.

Don’t fight the Fed.

The federal funds target rate (upper bound) averaged a paltry 0.84% on a monthly basis over the 15-year period in today’s table. At these levels, the average federal funds target rate (upper bound) was 226 basis points (bps) lower than the average increase in the CPI rate over the period. In our view, the Fed has been punishing bond investors by keeping rates at these low levels. Aware of the risk of losing money safely in bonds, investors looked elsewhere, with many of them deploying their capital into the equity markets. S&P 500 Index & Bloomberg U.S. Aggregate Bond Index Total Returns vs. CPI and Federal Funds Target Rate 15-year Monthly Averages Source: Bloomberg. Past Performance is no guarantee of future results.

Takeaway

On a total return basis, the Bloomberg U.S. Aggregate Bond Index did not keep pace with the increase in the CPI rate over the 15-year period ended in December 2022. While surging inflation in 2021 and 2022 accounts for some of the bond market’s lagging performance, it is our opinion that loose monetary policy at the Federal Reserve is the real culprit. At just 0.84%, the federal funds target rate (upper bound) was 226 bps below the CPI rate for the 15-year period in the table. That trend has not reversed completely. As of February 6, 2023, the federal funds target rate stood 175 bps below the CPI rate. With that in mind, it is our opinion that investors still run the risk of losing money safely in the bond market.