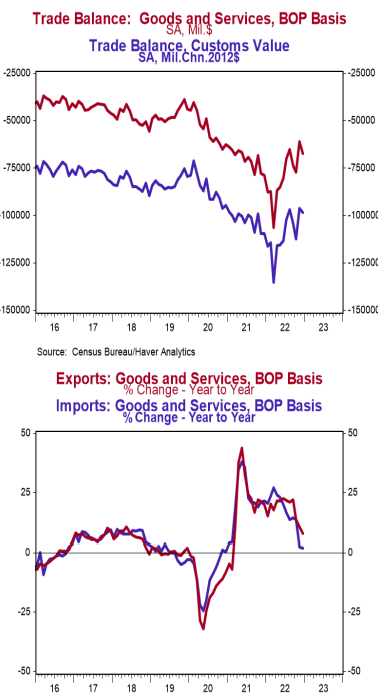

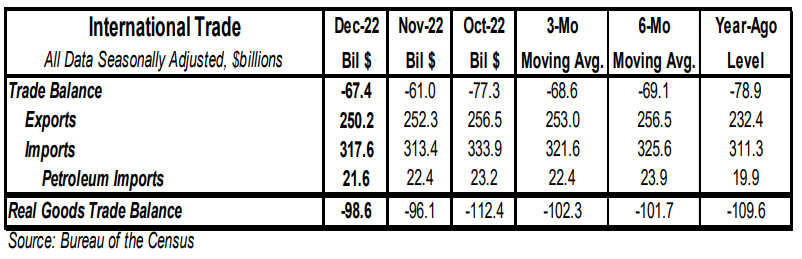

- The trade deficit in goods and services came in at $67.4 billion in December, slightly smaller than the consensus expected $68.5 billion.

- Exports declined by $2.2 billion, led by declines in nonmonetary gold, crude oil, and other petroleum products. Imports rose by $4.2 billion, led by cellphones & other household goods and autos.

- In the last year, exports are up 7.6% while imports are up 2.0%.

- Compared to a year ago, the monthly trade deficit is $11.5 billion smaller; after adjusting for inflation, the “real” trade deficit in goods is $11.0 billion smaller than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications:

The trade deficit in goods and services came in at $67.4 billion in December, as imports rose while exports declined. We like to focus on the total volume of trade (imports plus exports), which signals how much businesses and consumers interact across the US border. That measure grew by $2.0 billion in December, but was down 2.5% in the fourth quarter on the back of a 1.1% decline in the third quarter. The total volume of trade is still up 4.4% versus a year ago but continues to show signs of slowing. Unfortunately, the increase in the past year is driven not only by more goods and services, but also higher prices. Note that Russia’s invasion of Ukraine and the easing of COVID restrictions in China may affect trade patterns for some time. The good news is that supply-chain problems have improved dramatically. For example, Captain Kip, the Executive Director of Marine Exchange of Southern California, declared the container ship backup ended on November 22nd. It took twenty-five months, but things are finally back to normal at the Ports of LA and Long Beach. In some cases, waits have just shifted to other ports, but daily freight rates are also falling rapidly as demand has also weakened. A large part of this is due to a collapse in manufacturing orders in China. In the months to come, China manufacturing will be buffeted by the easing of COVID restrictions (good!) and a temporary spike of COVID cases (bad!), as the country suffers through cases postponed by overly strict measures in the past couple of years. If we believed the headlines about a decoupling, we would expect to see “less” trade with China, but trade in goods between our two nations hit a record high in 2022! Also notable in today’s report, the dollar value of US petroleum exports exceeded imports again. For 2022 US petroleum exports exceeded imports in nine of twelve months. For the full calendar year of 2022, the US became a net exporter again of petroleum products. What this means is much of the release from the Strategic Petroleum Reserve just flowed overseas.