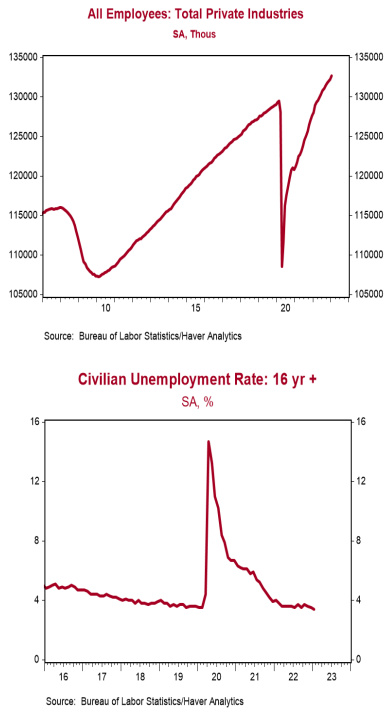

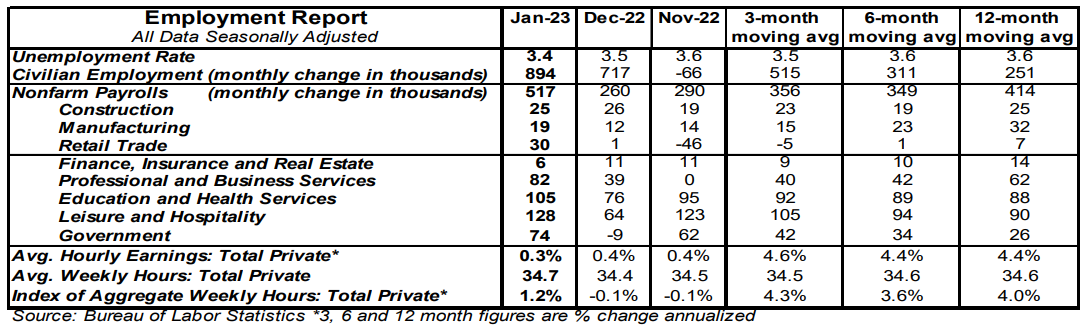

- Nonfarm payrolls increased 517,000 in January, easily beating the consensus expected 188,000. Payroll gains for November and December were revised up by a total of 71,000, bringing the net gain, including revisions, to 588,000.

- Private sector payrolls rose 443,000 in January and were revised up 75,000 in prior months. The largest increases in January were for leisure & hospitality (+128,000), education & health services (+105,000), and professional & business services (+82,000). Manufacturing increased 19,000 while government rose 74,000.

- The unemployment rate declined to 3.4% from 3.5% in December.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in January and are up 4.4% versus a year ago. Aggregate hours rose 1.2% in January and are up 4.0% from a year ago.

Implications:

If you weren’t confused by the economy already, today’s jobs data should have twisted your thinking into knots. In spite of the fact that retail sales have fallen for two months in a row, and the markets have seemingly priced in a “soft landing,” nonfarm payrolls rose 517,000 in January (plus 71,000 for prior months), easily beating the consensus expected 188,000. Meanwhile, the unemployment rate ticked down to 3.4%, tying the lowest level since the early 1950s. If you believe tight labor markets cause inflation (we don’t, but the Fed does) this is a reason to keep tightening monetary policy. Don’t expect the Fed to swallow its pride and go back to raising rates by 50 basis points in March, but investors should expect the Fed to raise rates by more than the futures market now expects and keep rates at higher levels for longer. The most impressive indicator for January was total hours worked, which surged 1.2%, more than offsetting modest declines in November and December. Yes, average hourly earnings rose a moderate 0.3% for the month, but the two sectors with the greatest payroll gains were leisure & hospitality and education & health services, which tend to have below-average earnings. An alternative measure of jobs (household employment) that includes small-business start-ups, increased 894,000 in January. But this incorporates new estimates of the US population and that change alone accounted for 810,000 of the gain in civilian employment. Add in the fact that the labor market is often a lagging indicator and it may be even more so now because this is the first time in more than twenty years that businesses face heightened recession risk due to tighter monetary policy (rather than mark-to-market rules or COVID lockdowns). Industrial production and retail sales are getting weaker, not stronger. As a result, we think many companies are getting out over their skis, continuing to hire in anticipation of business activity that, when it doesn’t materialize, will eventually force them to cut payrolls substantially. Mixed with a monetary policy that is now likely to get and remain tighter than the market anticipates, we continue to think equity investors should be cautious. COVID policies were unprecedented – so, we shouldn’t be surprised that the data are very volatile.