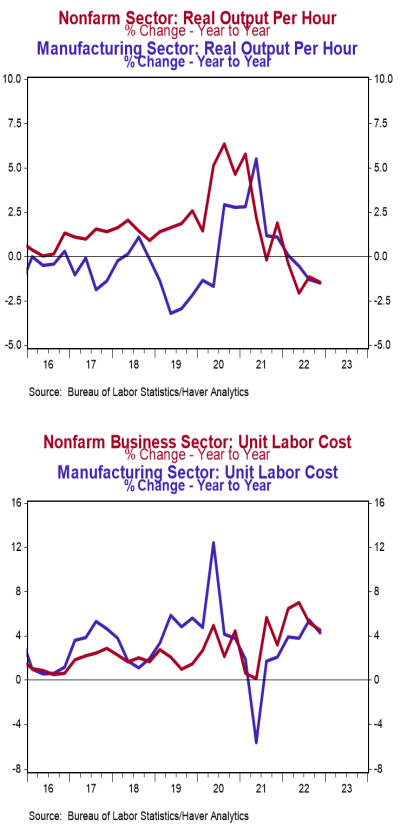

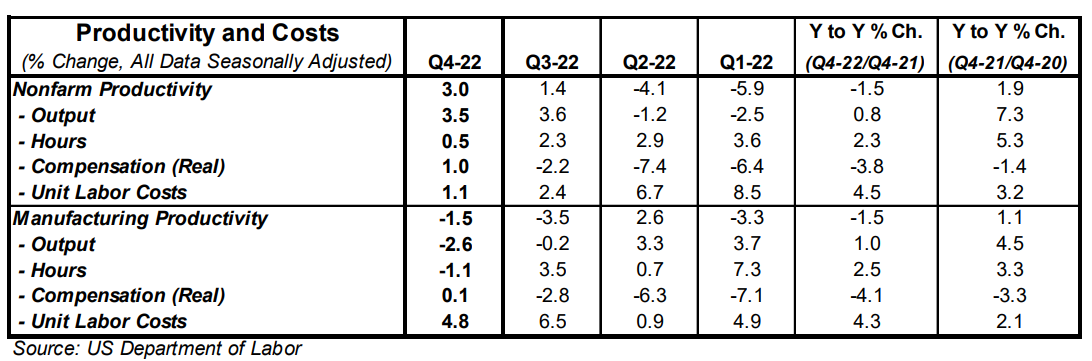

- Nonfarm productivity (output per hour) increased 3.0% at an annual rate in the fourth quarter, coming in above the consensus expected gain of 2.4%. Nonfarm productivity is down 1.5% versus last year.

- Real (inflation-adjusted) compensation per hour in the nonfarm sector rose at a 1.0% annual rate in Q4 but is down 3.8% versus a year ago. Unit labor costs rose at a 1.1% annual rate in Q4 and are up 4.5% versus a year ago.

- In the manufacturing sector, productivity fell at a 1.5% annual rate in Q4. Real compensation per hour increased at a 0.1% annual rate in the manufacturing sector, while unit labor costs rose at a 4.8% annual rate.

Implications:

Nonfarm productivity rose in the fourth quarter, increasing at a 3% annualized rate, as output rose at a quicker pace than hours worked, leading to more output per hour. Still, productivity is down 1.5% from a year ago, and for the calendar year of 2022, was down 1.3% versus 2021, the largest annual decline since 1974. Even though inflation is still high, “real” (inflation-adjusted) compensation per hour grew at a 1.0% annualized rate in Q4, the first positive reading of the year. However, inflation still remains a key headwind for workers’ purchasing power as “real” compensation is down 3.8% from a year ago. This will be an ongoing issue in the coming quarters, as inflation stays stubbornly elevated. On the manufacturing front, productivity declined at a 1.5% annualized rate as both output and hours fell, but output fell at a faster pace. This, along with other manufacturing data we have received over the past few months, shows that manufacturing has slowed and is likely in a recession already. Expect hours and output to continue to weaken in the quarters ahead. In other news this morning, on the employment front, initial jobless claims fell 3,000 last week to 183,000. Meanwhile, continuing claims for regular benefits fell 11,000 to 1.655 million. These numbers point to continued gains in jobs in tomorrow’s employment report. We’re estimating a nonfarm payroll gain of 185,000 with the unemployment rate increasing to 3.6%. Also earlier this week, cars and light trucks were sold at a 15.7 million annual rate in January, up 17.7% from December and 4.1% from a year ago. Don’t get too excited about this increase, though. Fleet sales to corporate purchases (think car rental companies) were the reason for the surge in January but are very unlikely to be repeated in the months ahead.