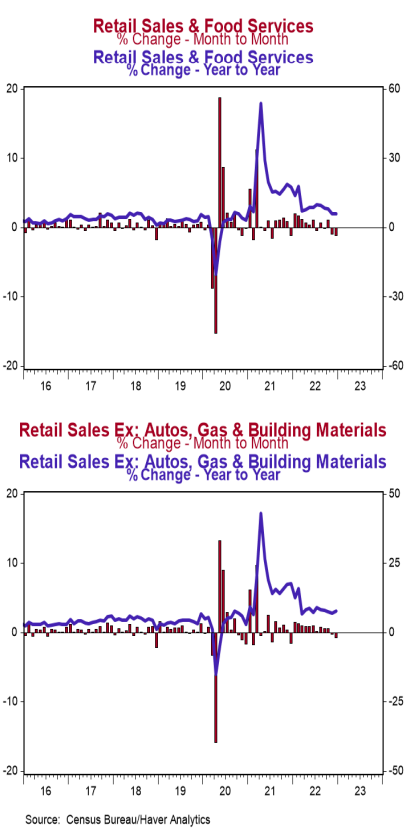

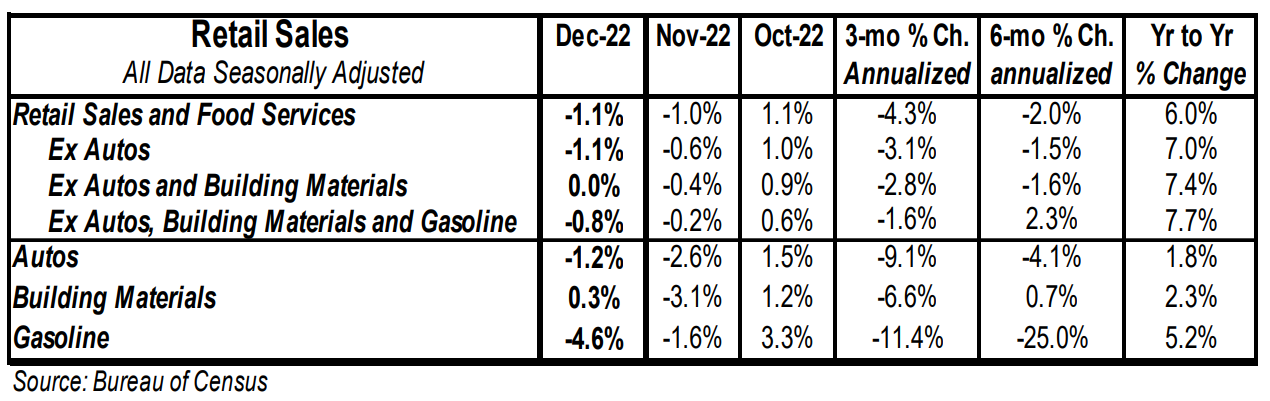

- Retail sales declined 1.1% in December (-1.8% including revisions to prior months), lagging the consensus expected decline of 0.9%. Retail sales are up 6.0% versus a year ago.

- Sales excluding autos declined 1.1% in December (-1.8% including revisions to prior months), well below the consensus expected 0.5% decline. These sales are up 7.0% in the past year.

- The largest declines in December were for gas stations, autos, and non-store retailers (internet and mail-order). The largest increase was for building materials.

- Sales excluding autos, building materials, and gas declined 0.8% in December. These sales were up at a 3.3% annual rate in Q4 versus the Q3 average.

Implications:

Retail sales sank in December, falling by 1.1%, which follows a downwardly revised 1.0% drop in November. The weakness in retail was widespread as ten of thirteen retail categories declined in December, led by gas stations, autos and non-store retailers (internet and mail-order), dropping 4.6%, 1.2%, and 1.1% respectively for the month. Some of the problems with retail is a continued shift to more spending on services from goods. But even the service category in the retail sales report, restaurants & bars, fell by 0.9% in December, the largest drop since January 2022. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas stations, fell 0.8% in December but were up at a 3.3% annual rate in Q4 versus the Q3 average. This measure is important for GDP. Plugging today’s data on retail sales and other reports into our models suggests real GDP grew at a 2.5 - 3.0% rate in the fourth quarter, although it’s anyone’s guess whether growth continued into Q1. The problem remains that one of the key drivers of overall spending is inflation. Yes, consumers spent more over the past year, but they are not taking home the same amount of goods. Although overall retail sales are up 6.0% from a year ago, that is not outpacing inflation, with the CPI up 6.5% over the same period. Due to very loose monetary policy and the massive increase in government transfer payments in response to COVID, retail sales are still running higher than they would have had COVID never happened. However, loose monetary policy, which helped finance that big increase in government spending, is translating into high inflation, which is why “real” (inflation-adjusted) retail sales are lower versus a year ago. This doesn’t mean overall consumer spending is down. Retail sales only measure part of consumer spending. The vast majority of services — medical care, education, housing rents — aren’t included, and most of the consumer spending is on services. Including services, overall consumer spending is still rising. Nonetheless, the payback from the monetary morphine injected by the Fed into the economy over the past few years is just beginning. The economy is starting to come back to a more painful reality.