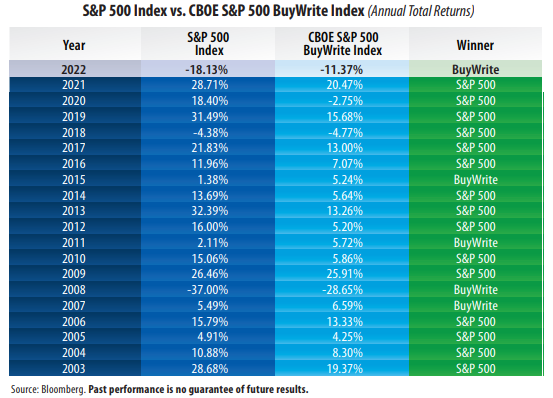

• Covered call strategies tend to be most beneficial when the stock market posts negative returns, or when returns range from 0%-10%

The S&P 500 Index posted negative total returns just three times in the table above. The CBOE BuyWrite

Index outperformed the S&P 500 Index in two of those three years (underperforming by a mere 0.39

percentage points in 2018). For comparison, there are four years in the table where the S&P 500 Index

posted returns between 0% and 10%. During those time periods, the CBOE BuyWrite Index outperformed

the S&P 500 Index in three of the four years (missing the fourth year by 0.66 percentage points in 2005).

• Covered call options can generate an attractive income stream, but they can also cap the potential for capital appreciation

There were 13 years in the table where the S&P 500 Index posted total returns of 10% or more. The CBOE BuyWrite Index underperformed the S&P 500 in every one of them.