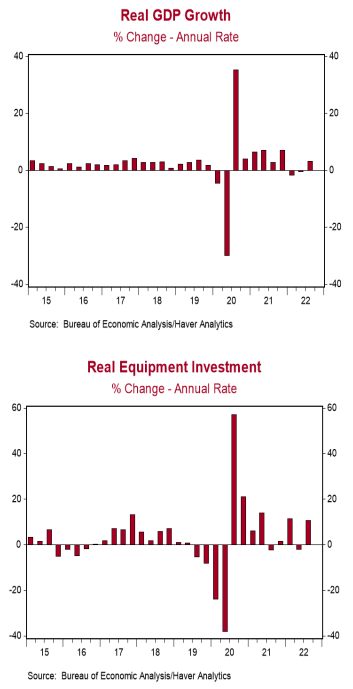

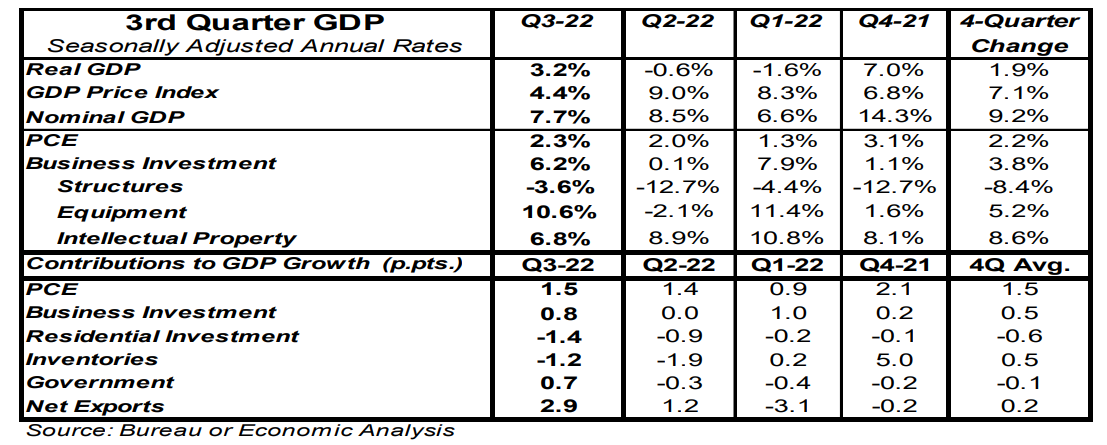

- Real GDP growth in Q3 was revised higher to a 3.2% annual rate from a prior estimate of 2.9%, beating the consensus expected 2.9%.

- Upward revisions to consumer spending, business investment, and government purchases more than offset a downward revision to inventories.

- The largest positive contributions to the real GDP growth rate in Q3 were net exports and consumer spending. The weakest components were home building and inventories.

- The GDP price index was revised up to a 4.4% annual growth rate from a prior estimate of 4.3%. Nominal GDP growth – real GDP plus inflation – was revised up to a 7.7% annualized rate from a prior estimate of 7.3%.

Implications:

Today’s final report on third quarter real GDP was revised higher to a 3.2% annual rate versus an estimate of 2.9% made a month ago. The upward revision to the overall number was due to upward revisions to consumer spending, business investment, and government purchases, which more than offset a downward revision to inventories. Today we also got our second look at corporate profits for Q3, which were revised higher. Economy-wide profits in Q3 showed a modest decline, but that was entirely due to lower profits reported by Federal Reserve banks. Take out Fed profits (as we do in our capitalized profits model), and profits rose 3.0% from Q2 and are up 8.9% from a year ago. Our capitalized profits model suggests US equities are roughly fairly to slightly overvalued today at current interest rates, although we believe equities will remain range bound in a bear market, with lower lows ahead until we eventually hit a recession, most likely starting sometime in 2023. Although some investors think a recession has already started, given two straight quarters of negative real GDP growth we saw in the first two quarters this year, we don’t think that’s right given the relative strength of other reports showing continued job creation, low unemployment claims, and growth in industrial production. Moving forward, we expect declines in corporate profits as the economy continues to re-normalize after the massive fiscal and monetary stimulus of 2020-21. In turn, this will be a headwind for equities, like the headwinds this year due to rising interest rates. Regarding monetary policy, today’s inflation news shows the Federal Reserve still has more work to do. GDP inflation was revised higher to a 4.4% annual rate in Q3 versus a prior estimate of 4.3%. GDP prices are up 7.1% from a year ago, nowhere near the Fed’s 2.0% target. Meanwhile, nominal GDP (real GDP growth plus inflation) rose at a 7.7% annual rate in Q3 and is up 9.2% from a year ago. In other news today on the employment front, initial unemployment claims rose 2,000 last week to 216,000, while continuing claims declined by 6,000 to 1.672 million. Combined, these figures suggest job growth remains positive, but not nearly as strong as earlier this year.