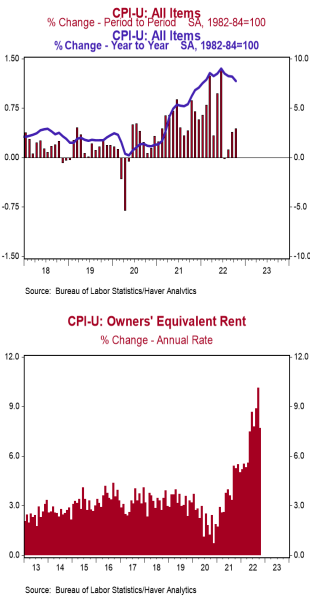

- The Consumer Price Index (CPI) rose 0.1% in November, below the consensus expected +0.3%. The CPI is up 7.1% from a year ago.

- Food prices increased 0.5% in November, while energy prices declined 1.6%. The “core” CPI, which excludes food and energy, rose 0.2% in November, below the consensus expected +0.3%. Core prices are up 6.0% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.5% in November, but are down 1.9% in the past year. Real average weekly earnings are down 3.0% in the past year.

Implications:

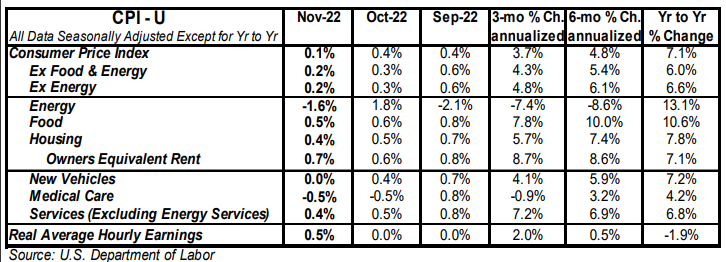

Consumer prices rose 0.1% in November, falling well short of the consensus expected 0.3% and pushing the year-ago comparison down to 7.1%. Some analysts will argue the smaller than expected monthly rise means that the Fed’s job in fighting inflation is over. We say pump the brakes; no matter which way you cut it, inflation remains well above the Federal Reserve’s target of 2.0%. The smaller than expected monthly rise was held down by a number of categories that declined for the month, some of which have been persistently volatile since the 2020 inflation scare began. Energy prices declined 1.6% in November, driven by lower prices for gasoline (-2.0%) and natural gas (-3.5%). Stripping out energy and its other volatile counterpart, food prices, “core” prices rose 0.2% versus a consensus expected rise of 0.3%. Housing rents were the main upward driver within the core, rising 0.7% for the month. We expect housing rents to remain consistently high in 2023 because they still have a long way to go to catch up to home prices, which skyrocketed during COVID. Some analysts point to “real-time” rental indexes based on what new tenants are paying, which have softened in the last couple months, as foreshadowing a drop in CPI rents. But this process will take time before they bleed into the CPI, which covers all tenants and homeowners, not just new tenants. Meanwhile, there were a handful of CPI categories that declined for the month, including prices for airline fares (-3.0%), used vehicles (-2.9%), and medical care services (-0.7%). While prices for vehicles and airline fares have been very volatile since COVID began, we expect the category for medical care services to be a persistent drag on inflation for the next year due to the way the government tracks health care prices and makes adjustments once a year (in October). While today’s report may be a welcome sign to the markets – make no mistake – the Fed still has a very long way to go before it can say the inflation scare is over. Expect a 50 basis point rate hike at the Fed’s meeting tomorrow, along with guidance that the Fed is prepared to continue raising rates in 2023.